Li Ka-shing’s CKI offers RM50bil for Power Assets

CKI will issue 1.36 billion new shares to buy the 61 percent of Power Assets it does not own, the companies said in a joint securities filing.

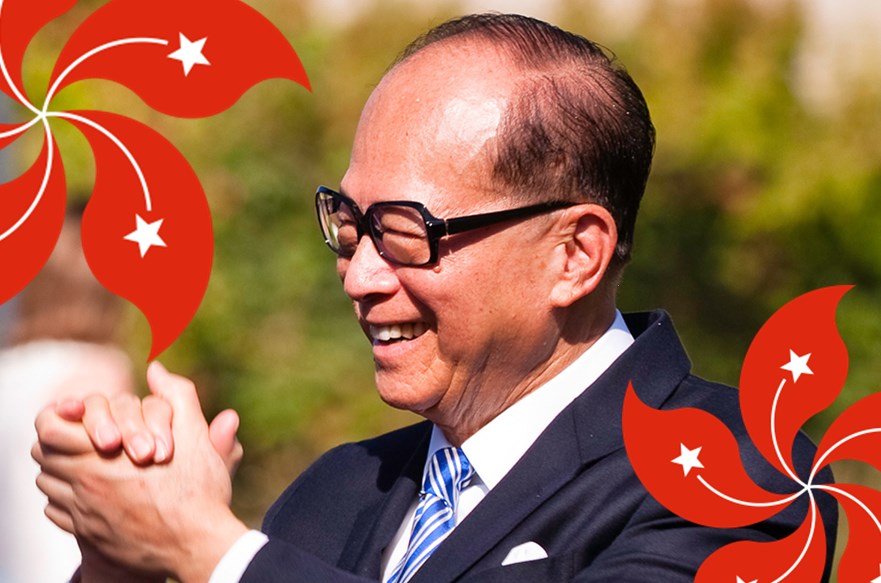

Victor Li, chair of Cheung Kong Infrastructure Holdings, gives a press conference in Hong Kong, September 8.

Li has always been Asia’s richest person, although he recently fell to second place with a fortune of $25 billion, according to Forbes.

The merged company will have a presence in Britain, Australia and Canada, with assets including Northumbrian Water, UK Rails and Australian Gas Networks.

In recent years, Li has accelerated his business transformation deployments by unloading his assets in Hong Kong and China and acquiring infrastructure companies in the USA and Europe, with CKI Infrastructure and Power Assets serving as the main platform for conducting overseas acquisitions of public utility businesses, especially following the European Union debt crisis.

After the merger, CKI will wholly own Power Assets, of which it now holds 38.87 per cent.

It would take only 10 percent of Power Assets’s independent shareholders to scuttle the proposal.

Cheung Kong Infrastructure said in a statement the deal would allow it to beef up its balance sheet so it can better compete for projects in the capital-intensive infrastructure industry.

Since January 2014, Cheung Kong Infrastructure has spent some HK$14 billion on acquisitions, while Power Assets has done about HK$5 billion of deals, Daiwa Capital Markets analyst Dennis Ip said in a February note.

After the acquisition, Mr Li Ka Shing’s flagship CK Hutchison Holdings will own 49.2 per cent of the combined company.

The reshuffle created a company focused on property, with the other operating assets from ports to retail stores spanning more than 50 countries.

Following the two rounds of massive restructuring operations this year, Li has successfully switched the incorporated base of all his listed business empire overseas from Hong Kong as part of his efforts to hand over the businesses to his elder son Victor, causing global news media to question Li’s hidden intention of withdrawing from Hong Kong.

The Li family in June sold a 19.9 percent stakes in HK Electric Investment & HK Electric Investments Ltd.to Qatar Investment Authority, the Gulf state’s sovereign wealth fund, for HK$9.3 billion.