Falling Mortgage Rates Could Bounce Back Up

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing an investor flight to safety for USA Treasuries is pushing average fixed mortgage rates lower and helping to keep buyer activity strong toward the close of the spring homebuying season.

Interest rates on residential loans moved lower this past week. Homeowner affordability has been strained, especially among first-time homebuyers.

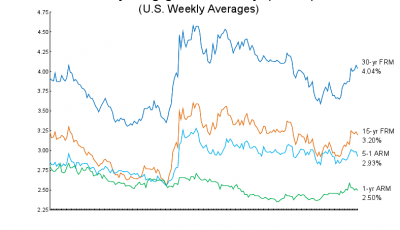

The 30-year fixed-rate mortgage (FRM) averaged 4.04 percent with an average 0.6 point for the week ending July 9, 2015, down from last week when it averaged 4.08 percent.

The average rate on five-year adjustable-rate mortgages fell to 2.93 percent from 2.99 percent; the fee remained at 0.4 point.

Mortgage rates took a step back from year-high levels this week as uncertainty in world financial markets continues to rankle investors.

The average 15-year fixed mortgage dropped to 3.28 percent, while the larger jumbo 30-year fixed mortgage sank to 4.07 percent. A year ago at this time, the 15-year FRM averaged 3.24 percent.

Today at Bank of America, the 30 year fixed mortgage is the same at 4.125%, and their 5/1 ARM is also unchanged at 2.75%. A year ago, the 5-year ARM averaged 2.99 percent. The minutes of the Federal Reserve’s June meeting also suggest that The Fed is moving cautiously and monitoring events overseas and in the US closely, he said.

The average rate for a one-year Treasury-indexed ARM was 2.50%, down slightly from 2.52%. With the average rate now at 4.14 percent, the monthly payment for the same size loan would be $971.04, a difference of $40 per month for anyone that waited just a bit too long.

Current mortgage rates for this Thursday at the nation’s top lenders are mostly the same as yesterday’s report.