Dollar pressured by decline in US inflation

“We can only assume the violent moves we’ll see if the Fed actually raises rates”, Boockvar said.

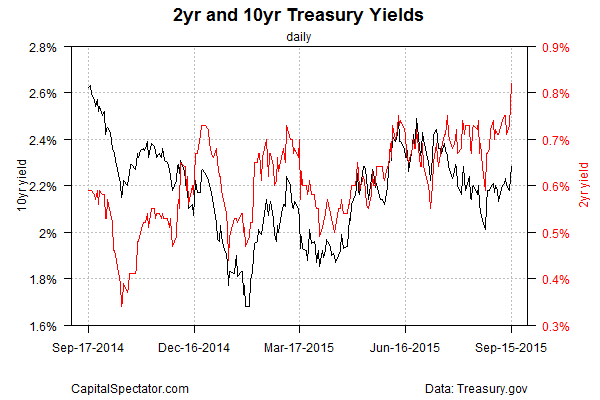

Later Tuesday, yields for short-term notes jumped dramatically, suggesting that Treasury investors were becoming more confident that a rate hike was in the offing. It is this two-year Treasury rate that I will be watching as the market digests the Fed’s policy announcements and forecasts and Fed Chair Janet Yellen holds her press conference.

“We will also see quarterly projections of growth, unemployment, inflation and the funds rate”.

On Tuesday, the yield on the 2-year Treasury note spiked to a four-year high of 0.78%.

And so the recent move in the 2-year does not imply that traders expect the Fed to lift rates this Thursday. “For risk assets the exact timing is nearly inconsequential”, said a Bank of America report released Thursday morning.

The 10-year yield, on the other hand, is in a holding pattern when viewed through the EMA prism.

But the unexpected 0.1 percent decline in U.S. consumer prices in August, the first since January, wiped out the dollar’s gains. Amongst longer maturities, the yield on the 30-year bond gained 9.eight foundation factors to three.044%, its highest level since July 28.

On Tuesday, the U.S. Commerce Division stated, with shoppers spending far much less on gasoline however extra on new automobiles and vans. Meanwhile, business conditions in the New York region continued to slump (http://www.marketwatch.com/story/empire-state-factory-gauge-remains-extremely-weak-in-september-2015-09-15) in September while industrial production fell a seasonally adjusted 0.4% in August.

“The numbers have been very uneven month-to-month, however whenever you look by way of the noise, the core readings have been very respectable for the Fed to have the ability to increase charges”, stated Robert Tipp, Prudential Fastened Revenue’s chief funding strategist.

Fed-funds futures, used by investors and traders to place bets on central bank policy, showed Thursday that bettors see a 25% likelihood of a rate increase later Thursday, according to data from CME Group. But Vanguard fixed-income guru Ken Volpert shared a refinement to that rule of thumb: To estimate how much an investor could lose during a 12-month period if Treasury yields increased by 1 percentage point during that same 12 months, subtract a fund’s SEC yield from its current duration.

Whatever the Fed’s determination, “the markets are successfully tightening earlier than the Fed“, Tipp stated, pointing to rising Treasury yields, widening credit score spreads and – all indications that buyers are bracing for the start of a mountaineering cycle.

The yield on the benchmark 10-year Treasury note sat lower, at 2.288 percent, after closing at 2.303 percent on Wednesday.