KKR Stock Falls After Samson Resources Files for Bankruptcy

KKR & Co.-owned Samson is planning to file for bankruptcy at midnight in Delaware, said one of the people.

It tries to reduce its $4.20 million debt, and second-lien lenders would gain the share of all the equity, if the plan goes on.

By filing with the support of the lenders, Samson could be able to implement its restructuring plan in the next few months.

The lenders have agreed to waive off their $1 billion debt owed to the company by having all of its freshly issued stocks. Those bondholders have also agreed to recapitalize the company with as much as $485 million in new loans and to support a rights offering. 68% of the second-lien lenders has already approved the plan. Concurrent with its petition, the Company also filed with the Court a Prepackaged Chapter 11 Plan of Reorganization and related Disclosure Statement. It said time is of the essence, given the difficult environment in which it is currently operating.

Samson’s move comes as energy companies across the U.S. are facing reduced prices for crude oil and natural gas.

Documents filed with the Court explain, “Oil and gas companies across the United States and around the world are feeling the pressure from the downward spiral in commodity prices, and the fate of many of these companies is yet to be determined”.

In 2007, KKR with private-equity peer TPG in led a $32 billion deal for Texas utility TXU Corp., the largest leveraged buyout ever. The firm began writing down the value of its 55% stake in Samson less than a year after the deal closed, and a May regulatory filing indicated its huge debts made its owners’ equity essentially worthless.

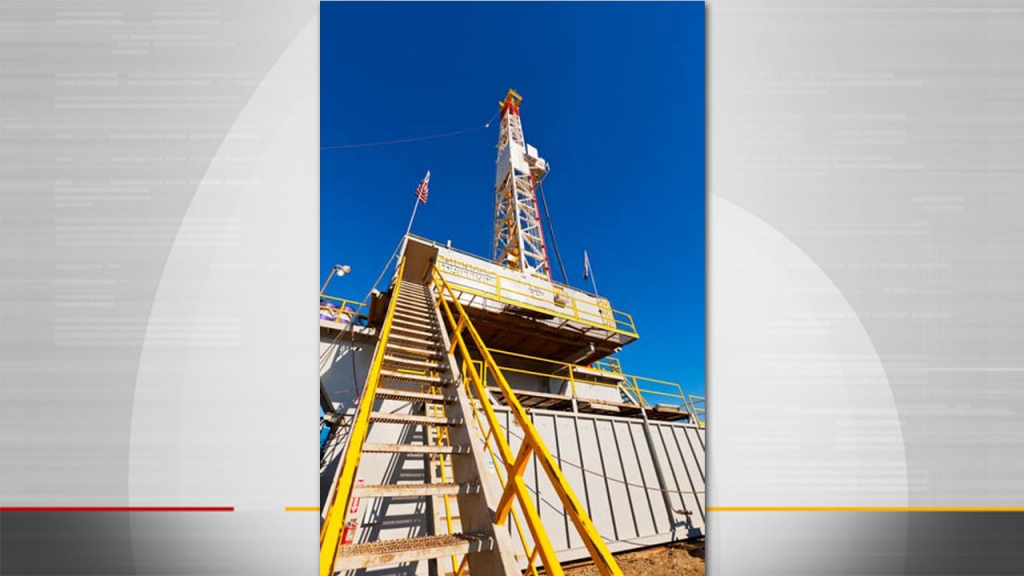

The investment by lenders may be further increased, under certain circumstances, by $35 million to improve liquidity, Samson said. Samson and other companies focused on hydraulic fracking and deep drilling, in order to extract oil and gas from the core.