Oil prices drop as Fed worries about global economy

The current global hand-wringing and head-holding over whether the US Fed will or won’t raise interest rates later has got investors here in Asia anxious about what this means for their economies.

“China is weighing on the demand side”. The figure could have been worse, were it not down to rising operating costs on new fields coming onstream, work on which had begun prior to the current oil price slump. This is at least partially due to the drubbing taken by the price of oil.

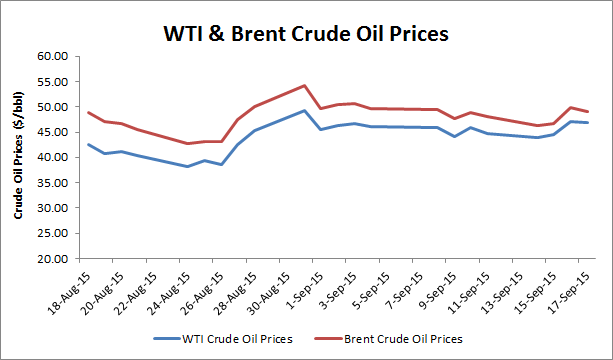

Oil prices steadied on Friday on a weaker dollar after the Federal Reserve kept rates unchanged, while bearish signs persisted that the world’s biggest crude producers would keep pumping at high levels to maintain market share.

Additionally, USA lawmakers could also be exclusively months away from lifting a four-decade-old ban on most oil exports, though the outlook for oil costs in 2016 and past recommend it might be years earlier than merchants care. The declines in September are now more than twice the gains made in August. Despite the claims of some, the US refining industry is responding to our increasing oil production and increasing production of lighter crude oils.

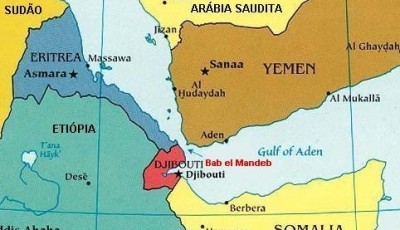

Secondly, Saudi Arabia’s state-owned oil company, Saudi Aramco, has confirmed that the acting president and chief executive, Amin H. Nasser, will assume these positions on a permanent basis. But even those with significant reserves could see new exploration projects and drilling halted in their countries. “Global demand by country is not very volatile, and is likely to grow slowly over time because … there’s a lag in response to lower prices“, he said. But the closer you can get to the well, the more oil and gas can be recovered.

Of late, most of the U.S. airlines have been minting a lot of money. Venezuela sends a large share of its oil exports to the United States because of the proximity and the operation of sophisticated U.S. Gulf Coast refineries specifically designed to handle heavy Venezuelan crude.

Concurrently, Fitch Ratings recently noted that depressed oil prices may stretch the liquidity of smaller E&P oil firms operating in Europe, Middle East and Africa, but much would depend on individual circumstances. The global glut of crude, which drove prices off a cliff past year, was largely fueled by the booming U.S. shale industry.

But as a result of the Fed’s determination was based mostly on financial considerations, some analysts and merchants had a special view. This was evident from the fact that most of the airline stocks increased by an average of 2% yesterday when the decision was announced.

“The impact of the… decision is somewhat mixed”, said Bernard Aw, market strategist at IG Markets in Singapore.