Fed chief Yellen expects interest rate hike this year

NEW YORK/LONDON: Gold gave up earlier gains on Friday, after the U.S. Federal Reserve chair Janet Yellen said she expects the Fed to raise interest rates at some point this year but pointed to concerns that USA labor markets remain weak. But she also outlined a host of concerns, from low wage growth to a low labor participation rate.

The Fed has said it won’t raise rates until it is “reasonably confident” that inflation will move back toward 2% over the medium term and sees further improvement in the labor market.

©2015 by The Associated Press.

But she said in a speech that it would be appropriate to start “normalising” monetary policy this year. Yellen also noted that cautious business owners “have not substantially increased their capital expenditures”.

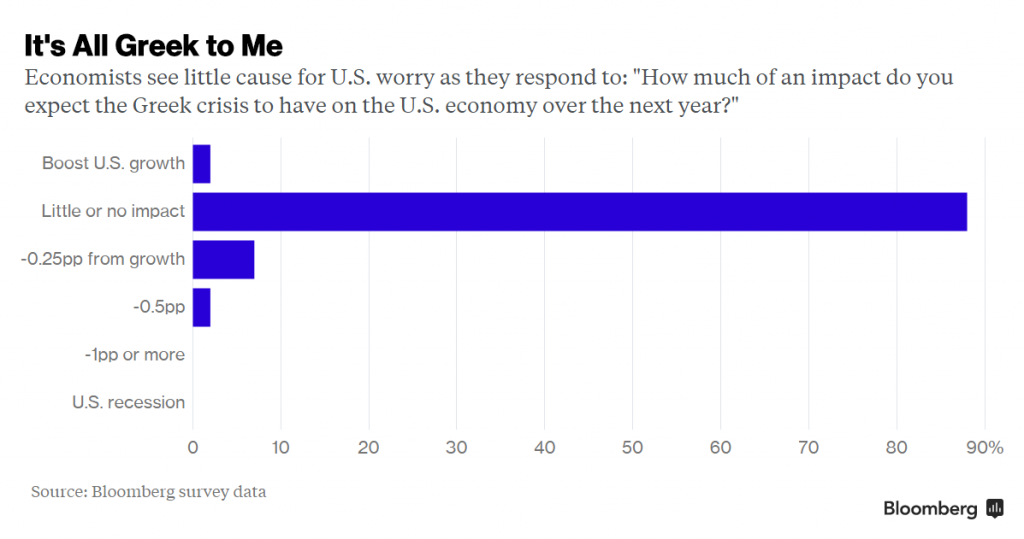

New potential risks have emerged since the Fed’s June 16-17 meeting, including the on-going Greek debt crisis and a sharp plunge in China’s stock market over the past month.

And she said that Greece’s economic crisis adds to uncertainty about the economic outlook. She did not mention developments in China at all, nor was she asked about Greece or China during a question-and-answer period following the speech.

In a toast that is actually warned regarding the performance workforce plus some of a given overseas hazards which have produced, Yellen created no straight touch about no matter he expects several rate hike all over the Fed’s four left-over get togethers in 2015.

But with the central bank preparing to raise rates for the first time in almost a decade later this year, Yellen described the USA economy as one prepared to hit a new level of growth sometime in the near future.

Yellen said she felt that initial step will have a small impact, and that the Fed would be raising rates only gradually from that point on.

Addressing the City Club of Cleveland, Yellen said that the economy is near the point where it does not need the support of rates at such an extraordinarily low level.

Even so, she said, “I think a significant number of individuals still are not seeking work because they perceive a lack of good job opportunities, and that a stronger economy would draw some of them back into the labor force”.

Yellen is scheduled to deliver the Fed’s mid-year economic report to Congress next week. “There is a healthy debate among economists – many within the Federal Reserve System – about some of the technical factors that may lie behind this pattern”, she said.