CFTC Deems Bitcoin Options to be Commodities, Takes Action Against Operator

To be more specific, Derivabit was operating for the goal of trading or processing commodity options without first complying with the Regulations set forth by both the CEA and CFTC.

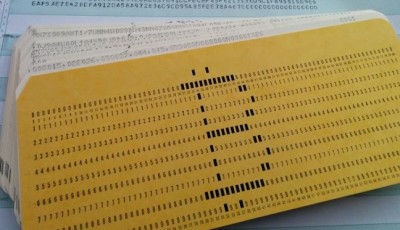

“Bitcoin has many uses – sometimes it’s used, traded as a commodity but it’s also used as a currency and a technology”. Under applicable law and CFTC regulations, swap dealers and other reporting entities are required to file with the Commission on a daily basis reports of swap positions involving certain physical commodities in excess of certain minimum levels in particular formats.

The U.S. Commodity Futures Trading Commission (CFTC) just added a lot more weight to bitcoin by taking action to declare it as a “commodity”, much like gold and silver. In a press release, CTFC’s director of enforcement, Aitan Goelman, stated: “While there’s a number of pleasure surrounding Bitcoin and different digital currencies, innovation doesn’t excuse these appearing on this area from following the identical guidelines relevant to all individuals within the commodity derivatives markets”.

The website derivabit.com hasn’t been active since mid-2014.

“Beginning in March 2014, Coinflip advertised Derivabit as a risk management platform…that connects buyers and sellers of standardized bitcoin options and futures contracts”. Later snapshots just said “Not now Accepting Customers”, and the domain was announced for sale on Bitcointalk with the source code in January 2015. “For these contracts, Coinflip listed bitcoin as the asset underlying the option and denominated the strike and delivery prices in US dollars”, the CFTC filing said.

Does theruling change the fundamental nature of what Bitcoin is, and how its advocates will use and develop it?We asked leading members of the bitcoin community for their views. So when they find a small one-man startup they cant resist giving themselves work to do so they go in and whack it, especially in California.

“I think the CFTC has a very weak case here and it’s a very creative reinterpretation of what the word commodity means”, he said. “The ruling will be challenged and judges will apply common sense and decide it to be a currency” as happened in the Silk Road case.

Of all the places in the world, United States of America is the only country that has managed to come up with innovative ways of slapping extra paperwork, fees, penalties and regulations on bitcoin. To stock regulators, it’s a stock.