USA stocks tumble on global growth fears, Volkswagen

Meanwhile, investors continued to assess the US Federal Reserve’s decision to leave short-term interest rates unchanged.

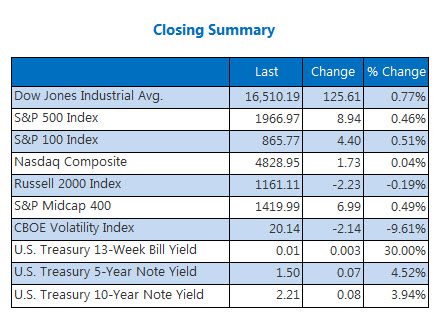

The Dow Jones industrial average rose 133 points, or 0.8 percent, to 16,519 as of 10:25 a.m. Eastern time.

The Standard & Poor’s 500 index rose eight points, or 0.5 percent, to close at 1,966.

Asian stock markets were mostly lower Monday after concerns about global growth weighed on USA and European share prices. The Fed, which cited concerns about global growth and financial tumult for holding off on rate hikes, appears to have created addtional uncertainty for investors.

Merck & Co. lost 1.7 percent, and the Nasdaq Biotechnology Index slumped 4.4 percent, the most in nearly a month after Hillary Clinton tweeted that she will lay out a plan Tuesday to take on “price gouging” in the specialty drug market.

Semiconductor company Atmel surged 12.7 percent on news it agreed to be acquired by Britain’s Dialog Semiconductor for $4.6 billion. The S&P 500 added 0.5% to 1967, while the NASDAQ closed flat at 4829 – weighed down by the biotech sector.

US stocks pared part of early gains to end higher Monday, as investors meditated on USA existing-home sales. Tokyo was closed for a three-day holiday.

“While last week’s Fed decision continues to weigh on sentiment, it seems traders today are spooked by a steep selloff in European markets“, Karee Venema, an analyst at Schaeffer’s Investment Research, said in a note. The Shanghai Composite Exchange gained 1.9 per cent to 3,156.54. The index was held back by heavy losses for shares of Volkswagen AG, which fell almost 19% after the U.S. Environmental Protection Agency accused the auto maker of deliberately cheating emissions tests.

In commodities, Brent crude oil was 1.8% higher at $49.08 a barrel.

The Dow is down 54.11 points, or 0.3 percent.

Bond prices fell. The yield on the 10-year US Treasury rose to 2.20 percent from 2.13 percent Friday, while the 30-year advanced to 3.02 percent from 2.93 percent.