China Must Stick to the Path of Economic Reform

So this “transition” is as significant – in a long-term sense – as any global economic event of the past 30 years.

But China’s stock markets dropped the next day in apparent disappointment with the “mixed ownership” plan, which falls far short of privatization and sets a cautious deadline of 2020 for implementation.

Jorgenson is critical of surprise moves like the August 11 devaluation of the yuan, which caused confusion in world markets, but he continues to see China’s economic growth as relatively strong.

Frankly, Xi inherited a bad hand after a decade in which Beijing kicked the most hard reforms down the road.

Those conditions would allow China’s economy to expand at around 7 per cent for the year, it said. Most Western analysts believe that the real rate will be slightly lower. Skeptics say empirical observations do not indicate such growth, arguing instead that 7 percent is a made-up figure resulting from official book-cooking.

The prospects for commodity and energy producers, from Australia, to Russian Federation and Brazil, aren’t what they were.

The US has not been immune to these trends. China uses coal for two-thirds of its energy needs.

To some degree, a slowdown of this kind is inevitable as China hits a point of diminishing return that many maturing economies face.

“China’s economy will continue to operate within a reasonable range in the latter half of the year, the overall stable momentum will not change and annual growth is expected at around 7 percent”, the National Development and Reform Commission said in an online press release. In the first quarter of the year, the added value of the financial sector grew by 16 percent, a jump rarely seen in any sector in recent years.

In a refutation to claims that the GDP rate have been over-stated by one to two percentage points, the NDRC said slumping import prices have only limited impact on China’s GDP calculation and the country now relies on the service industry for growth that consumes less global commodities.

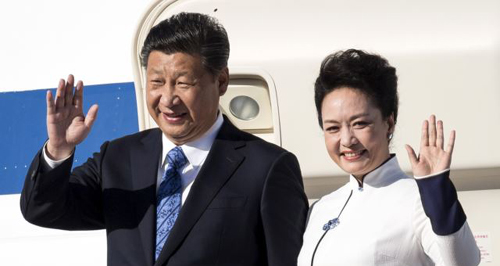

“China will stay strongly committed to deepening its reform on all fronts while opening still wider to the outside world“, Xi told the Wall Street Journal in a written interview before he departed for an official state visit to the United States on Tuesday. Wealthier, more educated citizens become better poised to provide professional services.

But the Chinese government’s intervention has distorted market forces to the long-term detriment of its economy.

China’s economic slowdown, stock market plunge and aggressive cyber activity have strained worldwide relations with Washington D.C.

Rather than market forces, these investments are often motivated by patronage or political considerations. Then, in February, the acquisition of Baccarat Hotel & Residences New York from the US’s Starwood Capital Group by China’s Sunshine Insurance was announced. China and others will form new institutions.

Newspapers recently have been overflowing with reports about China’s stock market and economy. What if China’s economy is actually bigger than everyone thinks?

The United States needs more investment too.

“Banks are slowly developing a backbone”, Hope said. China’s leaders pledged major reforms to liberalize the Chinese economy at the meeting, but they have yet to put many of them into practice. China’s state-dominated financial system carries out the policies of Beijing and serves as the instrument for targeted investments in strategic industrial sectors. Urbanization for millions of rural residents is underway and the government is boosting the role of innovation in the economy.

Meanwhile, Chinese purchases of foreign consumer products and technology are growing at rates that might surprise pessimists.

But recent efforts to control the market have only contributed to uncertainty, a problem that should be addressed by a clear communications policy, Jorgenson said.

More on Xi Jinping’s visit to the U.S.