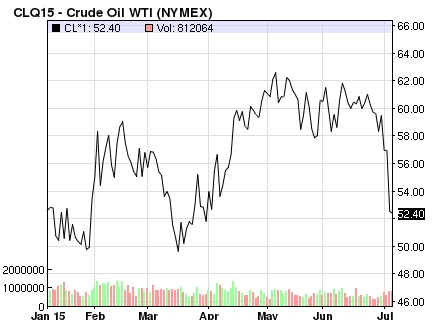

Crude Oil prices become stable after the sell-off

U.S. benchmark West Texas Intermediate for August delivery dropped 14 cents to $52.19 a barrel and Brent tumbled 13 cents to $56.72, both reversing an earlier uptick.

As investors try to sort out whether the global oil market has stabilized from a historic collapse, some elements suggest that the outlook for oil prices is only getting gloomier. Futures of gasoline and ultra-low sulphur diesel rose more than 1 percent.

SINGAPORE, July 10 (Reuters) – Oil prices rose on Friday on hopes that Greece could soon resolve its debt crisis and as Chinese shares opened up higher, but analysts said dramatic gains were unlikely as global production levels remained high.

“That is bearish for oil markets – particularly amid Greece, China and a still present oversupply of oil”, said Jamie Webster, senior director at the global energy consulting firm IHS. “If oil prices remain steady even at that (USD 80-85) level, I think we can manage the economy well”, Subramanian said at a lecture late last month at the Bangalore worldwide Centre.

The Market Vectors Oil Services ETF (NYSEMKT: OIH) traded down about 1.5%, at $33.14 in a 52-week range of $31.51 to $57.99.

GasBuddy reported some stations were posting prices as low as $2.35 in Akron as and low as $2.43 in Greater Cleveland.

Oil’s rebound is paring a second weekly loss that’s driven by China’s equities rout and the turmoil in Greece.

The Energy Information Administration (EIA) forecast Tuesday that production will average 9.5 million barrels per day by the end of the year, after seeing 9.6 million barrels a day in the first half.

■ Iran is eager to begin exporting oil that has been held back by sanctions, and talks between the USA and Iran that could lift those sanctions appear to be progressing. Commodities like oil that are priced in dollars tend to move inversely to the United States currency.

“Crude oil prices plunged yesterday as Greek uncertainty and worries over a slowdown of the Chinese economy weighed on market sentiment”, noted Sucden analyst Myrto Sokou. The American Petroleum Institute’s supply report on Tuesday showed a 958,000-barrel decline, ahead of Wednesday’s official data.

“It’s not only what’s happening here in the continental US, it’s what is happening throughout the world”, said Nancy White, a spokeswoman the AAA Motor Club, which tracks gasoline prices through its Fuel Gauge Report.

Then last week, the oil rig count turned positive for the first time this year, hinting that perhaps it oil producers were ready to ramp up production with prices seemingly stabilized.