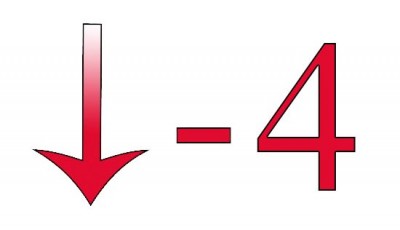

US crude oil inventories, July 8

Oil prices, 45% lower than a year ago, may need to decline further to reduce the supply surplus, the IEA said.

Front-month USA crude futures were trading around 57 cents higher at $53.35 per barrel.

Kloza thinks what’s happening to prices now – wild swings in crude prices that are a major factor in the price at the pumps and daily changes at the pumps – are a “dress rehearsal” for the fall when consumer demand drops markedly.

He said the result of the Greek vote could lead to either a watering down of the bailout demands by creditors or to a “full blown” exit by Athens from the eurozone currency union.

China’s economy significantly influences the price of everything from soybeans and metals to crude oil.

“While the market may have regained some of the confidence lost during the prior price drop, we don’t see any fundamental support for a move higher”, analyst Tim Evans at Citi Futures writes. “We still view global oil prices as too low on a 3-4 year time horizon, and Brent in the mid-$50s would likely discount much of the bad news”, they wrote.

Finally, the US Energy Information Administration (EIA) is due to release its weekly oil report later today.

Traders were keeping a close eye also on intense negotiations in Vienna between the West and Iran on curbing Tehran’s nuclear ambitions, said Gupta.

“That is bearish for oil markets – particularly amid Greece, China and a still present oversupply of oil”, said Jamie Webster, senior director at the global energy consulting firm IHS. As rigs and wells become more efficient and productive, and the costs to drill and complete wells continue falling, onshore production will grow again in late 2016, the EIA said. The agency’s price forecast for the best grade of US oil was $5 less than its European counterpart. Gasoline inventories also jumped, with the summer holiday driving season in full swing. Sanctions were imposed on Iran by the US and the worldwide community in 2010, targeting Iran’s economic activities. An agreement could allow Iran to boost oil exports, piling more downward pressure on prices.

“The correction is driven by the risk-off environment and prospects of even more OPEC oil”, Giovanni Staunovo, an analyst at UBS Group AG in Zurich, said by e-mail. Drilling permits were off 61 percent, oil well completions were down 36 percent, and employment declined 3 percent.