Consumer confidence higher in September but labor market outlook mixed

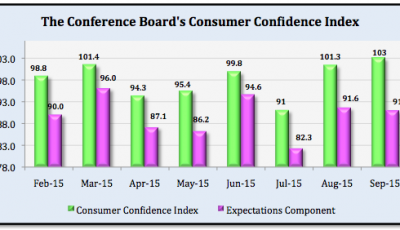

“Consumer confidence increased moderately in September, following August’s sharp rebound”, said Lynn Franco, Director of Economic Indicators at The Conference Board.

Last Friday, the University of Michigan said the final reading on its consumer sentiment index for September came in at 87.2 compared to the final August reading of 91.9.

“U.S. consumers seemed to shrug off these developments, instead focusing on the positive domestic outlook, which offers plenty of cause for optimism given a strong labor market, lower gasoline prices and a strengthening housing market”, he said.

The latest gain followed a more than 10-point jump in August.

Most analysts expected the number to fall back as opposed to reaching its current level.

The Conference Board, a business research group, said Tuesday that its consumer confidence index rose again to 103 in September after surging in August to 101.3. The reason behind these less-than-favorable expectations was the huge market pullback that has been seen over the course of September.

The proportion of consumers responding to the survey upon which the September index was based who described current business conditions as “good” rose 4.3 points to 28 percent.

Consumers’ assessment of present economic conditions hit the highest level in eight years. The portion saying jobs are “plentiful” climbed to 25.1% from 22.1%, though the ranks of those stating jobs are “hard to get” also increased, to 24.3% from 21.7%. About 15% expect more jobs over the next six months, unchanged from August, while the share anticipating fewer jobs rose to 15.8% from 14.5%. The percentage of consumers expecting business conditions to improve over the next six months increased from 16.6 percent to 17.9 percent, but those expecting business conditions to worsen also increased, from 9.1 percent to 10.3 percent. Only 39 percent of consumers expect a $1,000 investment in their 401(k) to be worth more than $1,000 a year from now, which is down from 42 percent last month. That view matches with better home and vehicle sales in recent months, big-ticket items that consumers can put off if they aren’t confident in their jobs or the broader economy.