Starboard Builds Minority Stake In Advance Auto Parts

Activist investor Starboard Value LP disclosed a 3.7 percent stake in automotive parts retailer Advance Auto Parts Inc on Wednesday and urged the company consider steps including a “substantial” dividend or buyback.

Following activist funds like Starboard Value is important because it is a very specific and focused strategy in which the investor doesn’t have to wait for catalysts to realize gains in the holding.

Jeff Smith will present the plans at the 2015 C4K Sohn Canada Investment Conference on Wednesday.

Shares of the auto parts maker closed at $170.53 on Tuesday on Nasdaq. The hedge fund believes the retail chain can close the bulk of that gap over the next several years by implementing a series of operational improvements.

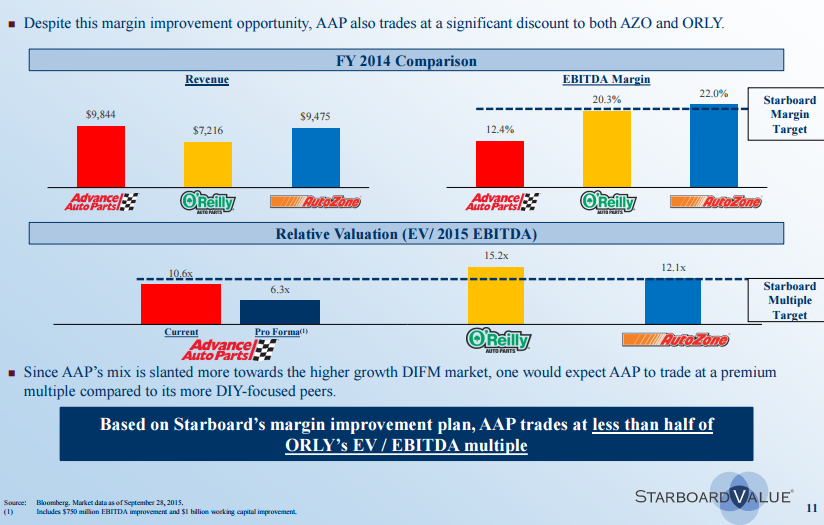

In its presentation, Starboard outlined how Advance Auto Parts’ operating margins are approximately 800-900 basis points below those of its closest peers.

The company, which sells vehicle accessories, batteries and replacement parts, makes more money from service stations than from sales directly to consumers at its more than 5,000 stores. The Motley Fool owns shares of O’Reilly Automotive.

The size of Starboard’s stake puts the hedge fund among the 10 biggest Advance Auto investors.

Starboard also says in the presentation that Advance Auto could top $360 per share, the Journal said.

Starboard believes that although Advance Auto stock has gained more than the S&P 500 that it joined in July, with the company’s shares rising 7% this year, with regard to profit margins it lags behind competitors AutoZone (AZO), which is up 17%, and O’Reilly Automotive (ORLY), which is up 26%, the Journal notes. We feel its strengths outweigh the fact that the company has had somewhat disappointing return on equity.