Local businesses affected by chip-embedded credit cards

The added hassle might motivate consumers to use phones to make wireless NFC (near-field communication) payments, which is quicker.

By now, most of us have received one of the new chip-based credit or debit cards from our bank or credit card issuer.

Since 2005, when the United Kingdom switched to the EMV standard, counterfeit fraud has decreased 63 percent, as noted in NerdWallet’s Consumer Credit Card Report, but that was after peaking in 2008, three years after the roll-out. Our society needs to ensure that if issuers and card brands wish to vacate their position of shared liability for fraud, they at least leave the “house in order” by implementing chip and PIN, while developing low cost and non-invasive methods of authenticating card not present transactions, or it is society who will continue to pay for the cleanup.

A few big changes are on the way for how you use your credit card when you go shopping. Experts said the process could take two to ten seconds longer.

To ensure optimal levels of customer service, First Niagara will initiate a rollout of new cards beginning in October 2015 and expects to convert the majority of its card portfolio in early 2016.

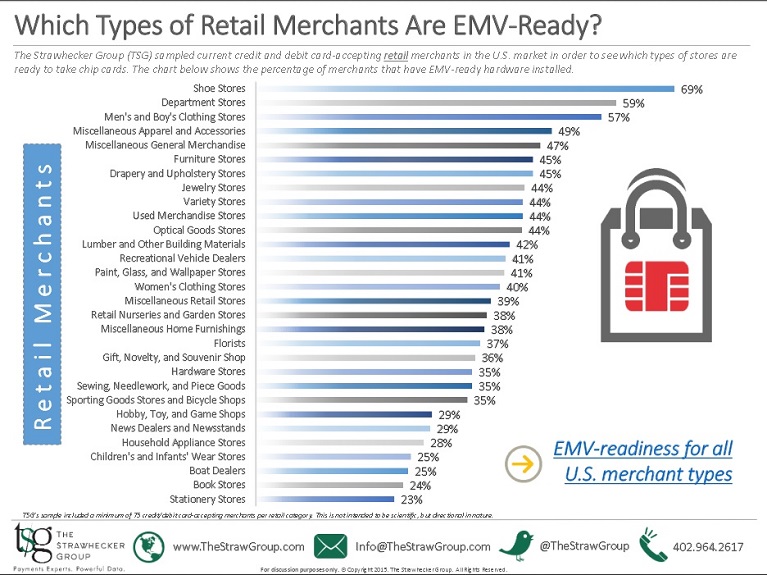

“While many retailers have not yet upgraded their terminals, big-box merchants such as Walmart and Target are ready for 1 October”.

If you have a chip card and you’re at a chip terminal, the machine won’t let you swipe it as we’re accustomed to doing. If a card with no chip is used to commit fraud, then the bank accepts responsibility even if the retailer does not have a chip reader.

The new cards really are safer and a long-needed, major step forward in fraud protection. “Unlike a magnetic-striped card, chip cards are inserted into the reader and left in the machine while the chip on the card and the terminal actually agree on a secret, one-time code that can’t be copied by a bad guy”. Consumers are protected by law, which makes them liable for no more than $50 of any unauthorized purchase.

Dayton hairstylist Zaria Dixon said she is purchasing an EMV reader for her business and is shocked by the cost. This spells the end of any hope of getting PIN required on all card transactions.

Thursday marks a milestone in the effort to shift the U.S.to the use of microchip-embedded credit cards, a more secure alternative to traditional cards that require the swipe of a magnetic stripe.

Visa, MasterCard and American Express have been shipping new chip cards to millions of card users for months. Banks and card companies seem to prefer taking a customer’s signature with a chip credit card, rather than have customers memorize a PIN to use with a chip credit card. Many retailers are still putting the new cards readers in place.

CreditCards.com conducted a similar survey in late January and found 31% of USA credit cardholders had a chip-enabled card.

The transition for retailers and banks involves new hardware, software and payment cards. You need JavaScript enabled to view it.to receive a new free EMV compliant terminal.