Major hikes expected as state releases 2016 insurance rates

The hikes affect anyone that buys individual or family health plans through Minnesota’s insurance exchange, MNsure, set up in the wake of the Affordable Care Act, as well as those who buy directly from insurers.

All five companies sought increases in excess of 10 percent, including a requested spike of more than 50 percent by Blue Cross.

He noted that many people buying coverage through MNsure will be eligible for subsidies that will ultimately lower the actual cost from the sticker prices made public Thursday. Beneath those figures, however, is a much more complicated truth, since particular health insurance products will have different levels of increase. But the individual market is at the heart of President Barack Obama’s health care law and the health insurance exchanges such as MNsure it gave way to.

Gov. Mark Dayton released a statement saying he is “extremely unhappy” with the rate increases and said that citizens will demand that insurers’ “excessive administrative overheads” be eliminated.

Rothman attributed the cost problems, in part, to a greater number of sicker people applying for coverage through MNsure, as well as rising drug costs.

“We had rates that were not appropriate”, said Danette Coleman, Medica’s senior vice president for individual business. “We squeezed out everything we could that was not actuarial justified”.

The state’s largest insurer, Blue Cross Blue Shield, will up its rates on average by 45-49 percent for its 179,000 private customers, the Star Tribune reports.

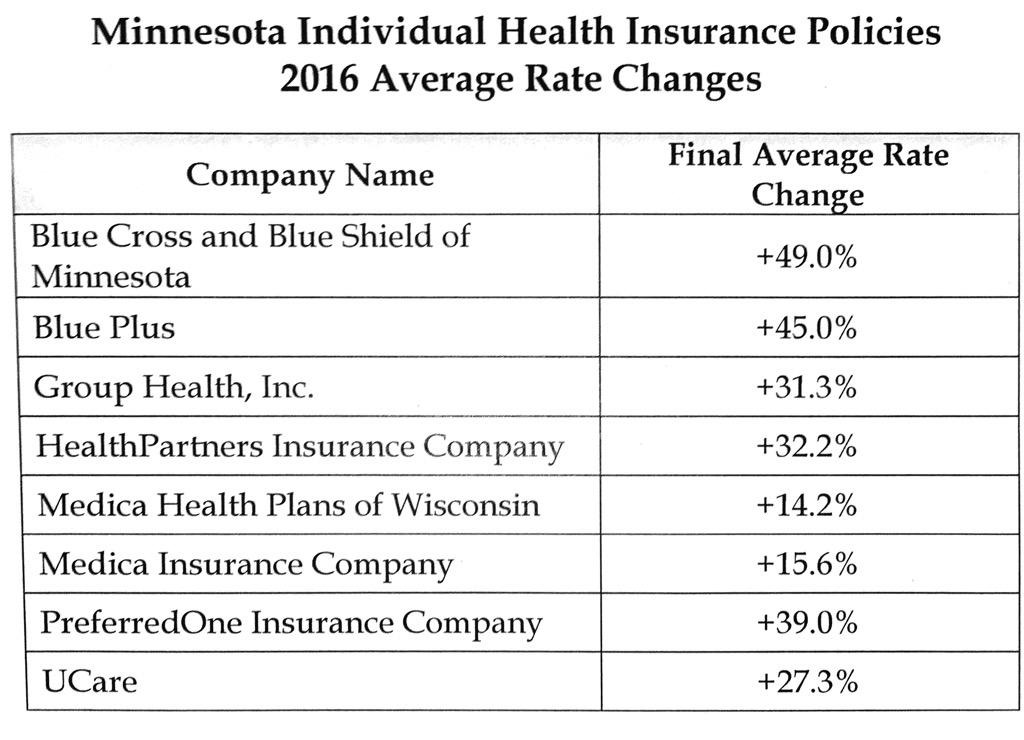

FOX 9 has compiled a list of the average rate hikes (so not everyone will pay this much more) for the eight companies providing individual health insurance plans in Minnesota. Republican House Speaker Kurt Daudt said GOP lawmakers would renew an attempt to abolish MNsure and move to the federal marketplace next year, though it’s unclear whether that would have any impact on rates in Minnesota. He also called on the Legislature to create new state-based mechanisms to hold down rates including a new reinsurance program.

“This really is a failed policy”.

“It has not lived up to even the most conservative estimates”, Daudt said, citing both registration numbers and initial promises of cost savings under MNsure.

According to the Pioneer Press, this is just 6 percent of Minnesotans, with the rest mainly getting health insurance from their employers, or by qualifying for state-run programs.