Clinton calls for repeal of health care law’s ‘Cadillac tax’

Many unions have held off from endorsing Clinton, often because their rank-and-file members prefer her primary opponent Vermont Sen.

Supporters of the tax have argued that it could be powerful health care cost control mechanism. Mrs. Clinton’s marketing crusade aides knowledgeable Randi Weingarten, the president of the American Federation of Teachers, of her intentions within the previous couple of days, in accordance to a senior official with the toil group.

While unions support more comprehensive plans, proponents of the tax say that beneficiaries of high-cost health plans are shielded from the high costs of health care thanks to the low deductibles and premiums of their plans.

Unions generally oppose imposition of the tax because generous health-care plans have been a perquisite given to union workers in lieu of pay raises or other compensation.

Clinton said a few of her proposed reforms to Obamacare, which she has rolled out in the past month, would more than cover the cost of repealing the Cadillac tax, a measure that helped to pay for the health care reform law.

The Cadillac tax was meant to discourage extravagant coverage, which experts say encourages overtreatment and adds to costs.

A recent analysis from the nonpartisan Kaiser Family Foundation estimated that 26 percent of all employers would face the tax in at least one of their plans during its first year.

The much-maligned provision would impose a 40% excise tax on all employer-based plans with annual benefits exceeding $10,200 for individuals and $27,500 for families beginning in 2018.

The Obama administration says critics overstate the potential impact of the tax. Since health care costs have historically increased at a faster rate than inflation, all employer-sponsored plans would eventually be taxes.

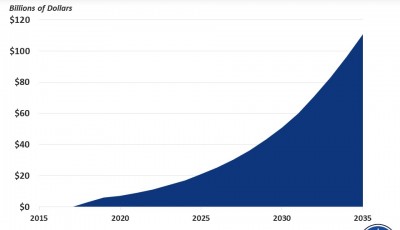

A new estimate by the congressional Joint Committee on Taxation puts the 10-year cost of repeal at $91 billion.

“We are proud that Hillary Clinton has come out in favor of a repeal of the so-called Cadillac tax – a harmful tax on health benefits that is hurting America’s working families”, she said.