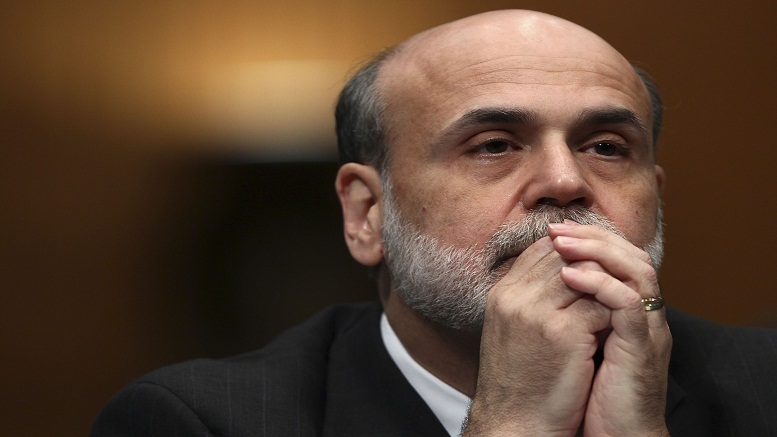

Ben Bernanke thinks more bankers should be in jail

Bernanke, now a distinguished fellow at the Brookings Institution, left the Fed in January 2014 at the end of his second term, after serving eight years as chairman during the turbulent times before and after the 2008 financial crisis. That is “an enormous difference” from the Eurozone, where output is only 0.8 percent higher than its previous peak.

Bernanke is intensely critical of the austerity policies imposed by European governments after the crisis and, to a lesser extent, by Congress. This is unsurprising, since Bernanke throughout the crisis pleaded consistently for more expansionary government fiscal policies and, when they didn’t appear, took up the slack through an aggressively expansionary monetary policy from the Fed.

As for new regulations imposed on banks after the crisis, Bernanke defends the Obama administration’s decision not to push for a new Glass-Steagall type wall between investment banking and traditional banking. “If you raised rates too early and kill the economy, that doesn’t help you”, he said.

Since leaving the Fed he signed on as an adviser to one of Wall Street’s biggest hedge funds, Citadel, as well as asset manager Pimco. Mr Bernanke defends the Fed’s financial interventions, as well as its monetary policy rescue, which involved cutting rates to near-zero and a vast bonds purchase programme.

Regarding the bankruptcy of Lehman Brothers, for example, Bernanke said, “We were very, very determined not to let it collapse, but we were out of bullets at that point”.

He said that the slower overall pace of gross domestic product since the Great Recession was due to a downturn in productivity and other issues outside the purview of monetary policy.

“Yeah, I think so”, he replied.

No longer a policymaker, Bernanke is letting his hair down in his soon-to-be-released memoirs, “The Courage to Act: A Memoir of a Crisis and Its Aftermath”.

In the interview, Bernanke refused to second-guess the job being done by his successor, Janet Yellen. Ultimately, whether Wachovia had violated its deal with Citi was a matter for the courts, not the Federal Reserve, and the Fed gave its consent, Bernanke writes.

Bernanke also says, in his view, the FDIC’s handling of the Washington Mutual failure in September 2008 “did hasten the fall of the next financial domino – Wachovia”.

Mr Bernanke argues the United States is well-placed economically compared with many of its partners, in part because of more favourable demographics and a record for technological innovation.