Executives ‘Should Have Been Jailed Over Crisis’

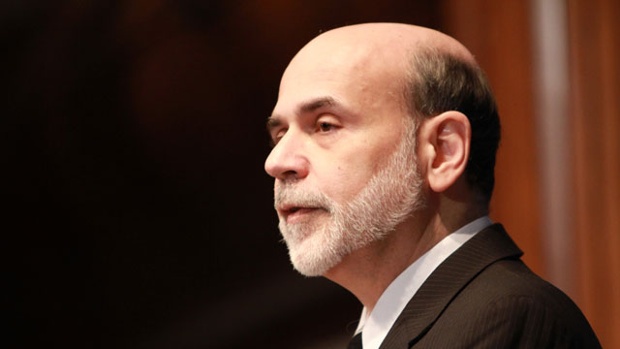

Federal Reserve Chairman Ben Bernanke testifies before the Senate Banking, Housing and Urban Affairs Committee on his re-nomination to the position December 3, 2009 in Washington, DC. Sen. The 5.1% headline unemployment rate would suggest that the labor market is close to normal.

Bernanke spoke with CNBC on Monday to discuss a range of economics matters, including the Fed, jobs, interest rates and the stock market. Creating an environment to foster stability in the financial system, that’s the third object, he said, but one that should be pursued on the regulatory and supervisory fronts, not monetary policy, “and to be tough about that”.

But he already had to go on the defensive because he’s been criticized for the title of the story, “How the Fed Saved the Economy”. In contrast, the output of the USA economy is 8.9% above the earlier peak-an enormous difference in performance.

“The slow growth is coming from slow productivity growth”, Bernanke said. He said other policymakers in the government need to step up.

With the Fed considering a rate hike that would be the first in nine years, he said it’s not evident that monetary policy is too easy because inflation is so low and full employment is only starting to emerge. In November 2010, when the Fed embraced its second round of quantitative facilitating, German Finance Minister Wolfgang Schäuble supposedly called the activity “confused.”

It is informative to think about late USA financial execution with that of Europe, a noteworthy industrialized economy of comparable size.

Bernanke, an avid student of the Great Depression of the 1930s, was among the principal architects of the US response to the recession of 2007-09, in which the Fed supported pivotal moves including JPMorgan Chase’s takeover of investment bank Bear Stearns as well as Bank of America’s acquisition of Merrill Lynch.

He also said long-term low or no inflation has risks.

Bernanke who had been constantly tweeting about his new book, “The Courage to Act: A Memoir of a Crisis and Its Aftermath”, while making promotion rounds on twitter.

Regarding the bankruptcy of Lehman Brothers, for example, Bernanke said, “We were very, very determined not to let it collapse, but we were out of bullets at that point”.

After Wells Fargo agreed to buy Wachovia in 2008, former Federal Reserve Board chairman Ben Bernanke spent several hours assuring the North Carolina congressional delegation that the deal “did not mean the end of the bank’s role as a major employer in Charlotte”.