Oil prices look slippery

“The supply response to lower prices is on the way”, the IEA said, adding it may take another price drop for a full supply response to unfold.

On the demand side the main shocks may come from China and the Eurozone. “Oil will probably trade sideways until the dust settles and I think we’ll spend more time around this level”.

Oil prices have increased following a surge in Chinese stock prices and possible resolution of Greeck debt crisis. However, ISIS has to sell its oil at a discount because it must go to the black market for buyers.

This is because most signs point towards Iranian leader Ali Khamenei acknowledging the fact that it would be in his own political interest to finalize the deal and offer some stability to the country, long embroiled in a verbal and cultural conflict with the West. Can the Chinese economy, which is so dependent on foreign investment, morph into a more sustainable model of consumption, productivity and efficiency?

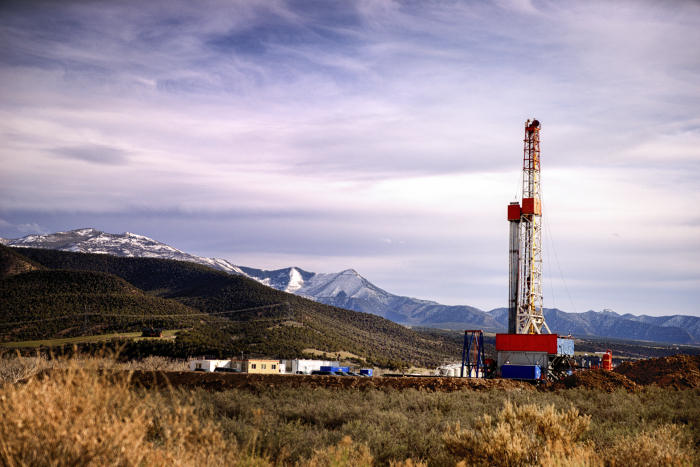

The resilience of U.S. shale oil production has impressed many traders. “Investors have justifiable concerns about the outlook for both supply and demand going forward given current events”, Reuters reported.

The third factor affecting oil was Iran.

Should Congress not be able to decide by Friday morning, discussions will go on for another month.

Greece has tabled a cash-for-reforms proposal to creditors, raising hopes that a deal could be reached this weekend.In China, the CSI300 stock index was up 5 percent shortly after Friday’s opening, extending gains from the previous session after the government launched emergency measures to halt a 30 percent fall in prices since June which had put pressure on global markets.

On the Intercontinental Exchange (ICE), brent crude for August delivery gained 0.09 or 0.15% to $58.70 a barrel. In 2016, Commerzbank expects Brent to average $73 a barrel, down from its prior forecast of $78 a barrel. Generally speaking, the United States dollar and oil prices tend to move in opposite directions.

It identifies the low oil price and resultant spending cuts as the main reason for the cutbacks. This is definitely not the case over the medium term. The USA rotary rig count from Baker Hughes was up 3 at 862 for the week of July 3, 2015. A week earlier, USA oil rigs rose by 12 to 640, ending a 29-week streak of weekly draws. Back in January, we predicted such a deal would be struck this year; while no one can say precisely when it will be concluded, the expectation is in the coming several weeks, and possibly the next few days. A small but significant player, Libya couldput another million barrels of oil a day on the market in three months, he said.

Oil ETPs have seen inflows.

Meanwhile it stated worldwide oil output grew by 550,000 barrels a day in June alone, to ninety six.

“This steep rise is attributable to the ramp-up in production from Gumusut-Kakap field”.

The IEA noted that oil prices will have to decline further in order to reduce the currency supply surplus.