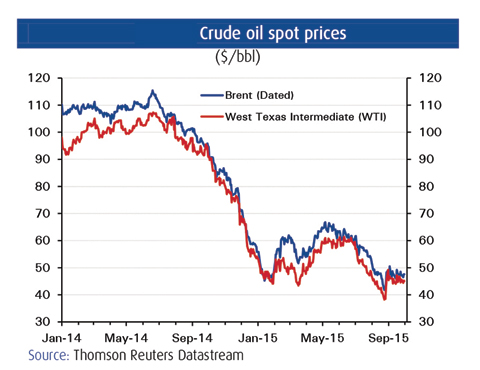

Oil price rally falters

U.S. West Texas Intermediate (WTI) crude futures were trading at $49.79 per barrel at 0008 GMT, up 16 cents from their last settlement.

The comments followed data from oil services company Baker Hughes that showed the number of United States rigs drilling for oil fell for a consecutive sixth week.

“The market just wasn’t able to sustain the higher levels reached last week”, said Tim Evans, an energy analyst at Citi Futures Perspective in New York.

“OPEC is confident that it will see a more balanced market in 2016″, Badri told an oil and gas conference in Kuwait City.

OPEC’s strategy of pumping oil at high levels to squeeze out US production is apparently working as the 12-nation producer group is forecasting that USA oil output will decline in 2016 for the first time in eight years.

Growth in supplies from non-OPEC producers over the past five years has substantially reduced in 2015 and is likely to show zero to negative growth in 2016, the statement said.

Market confidence is up because we are hearing the same message from everywhere that market is rebalancing, said Barnabas Gan, an OCBC oil analyst, identifying Asia, particularly China, as the main demand driver in the near term.

Non-OPEC oil supply growth in 2015 now stands at 0.72 million barrels per day, following a downward revision of 0.16 million barrels per day from the previous report, which was attributed mainly to a downward adjustment in the US, according to the report.

Many traders on the street believe that the tensions in Syria are acting as a huge support for crude prices as many believe that it could impact the supply equation in the near term.

“The market may be off balance for a while longer”, the Paris-based adviser to 29 nations said in its monthly report.

In neighboring Iran, OPEC’s fifth-biggest producer, output capacity may return to as much as 3.6 million barrels a day within six months of sanctions being lifted, the IEA said.

Signs that OPEC members were producing full steam ahead, however, created a mixed outcome in early market trading.

Not as prominent in the analysis is whether US frackers, hurt by the falling price of crude, will live to fight another day. “US crude stockpiles are also expected to rise when released later this week”, ANZ said in a note on Tuesday.