U.S. on track for rate hike: Dudley

Dudley, as president of the New York Fed, is the vice chairman of the Fed’s monetary policy committee.

Taylor said the Fed should set a simple policy rule, similar to one he developed in the 1990s, which would lay out a clearly-defined strategy. “Recent weakness in the Chinese economy and a few other worldwide markets may have caused the Fed to delay the inevitable rate rise”, said Dr. Robert Atra, Chair of the Department of Finance at Lewis University.

For the Fed to effectively guide the economy, “households and businesses need to be able to anticipate how the Federal Reserve is likely to respond to evolving conditions”, Dudley said in prepared remarks for a panel in Washington.

The greenback’s strength since June 2014 has been a drag on the U.S. economy and has made the Fed reluctant to hike near zero rates.

New York Federal Reserve Bank President William Dudley speaks at a Thomson Reuters newsmaker event in New York April 8, 2015.

The Fed surprised half of Wall Street in September by holding rates steady.

Bloomberg earlier reported that Republican presidential candidate Donald Trump said in an interview that “Janet Yellen for political reasons is keeping interest rates so low that the next guy or person who takes over as president could have a real problem”.

Also the Fed´s closely watched Beige Book report on the economy said that while expansion continued modestly the stronger dollar in recent months was “restraining manufacturing activity as well as tourism spending”.

“A lot of the things the Fed is concerned about are not going to be cleaned up by December”, said Mr John Briggs, a strategist at the Royal Bank of Scotland.

GE shares jumped 1.36 percent after the company beat profit expectations with $2.51 billion in its third quarter, though it slightly missed on revenues, which declined 1.3 percent to $31.7 billion.

“This is the Fed’s ‘known unknown, ‘ and a risk management approach will require more patience to assess the incoming labor market data for an answer to the question of whether this is a realignment in the labor market dynamics to a more sustainable path, or a more worrying relapse in the recovery”.

“I don’t want to make too much of that”, Dudley said.

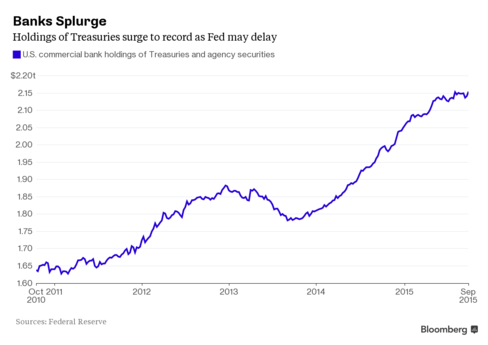

The main story behind the latest rally has been the likelihood the Fed will have to put off a rate hike until the new year owing to a slowdown in world economic growth.

As a outcome, the focus has turned to the final FOMC meeting of the year with market pricing around a 30% chance of a rate hike. “But disagreement over the timing of liftoff is getting much more heated and personal than I would expect and I think it’s legitimate that it should be a very rigorous debate because they are trying to decide which would be worse”, said Swonk.

Separate figures showed the number of Americans applying for jobless benefits fell to its lowest level since 1973 last week.