Oil prices gain due to increase in USA inventory levels

USA propane exports have been increasing rapidly and competing in markets much further afield than was the case in the past, according to the EIA (“U.S. propane exports increasing, reaching more distant markets” November 3). Russian oil output broke a post-Soviet record in October for the fourth time this year.

Industry group American Petroleum Institute and analysts polled by Reuters expect the EIA to announce a crude build of 2.8 million barrels last week, which would be a sixth straight week of builds.

Gasoline stocks have fallen more than 8 million barrels over the last four weeks while distillate stocks have been down for seven consecutive weeks by a total of more than 13 million barrels. Total processing was 15.6 million barrels a day last week, 21,000 barrels per day more than the week before.

USA benchmark West Texas Intermediate for delivery in December slid $US1.12 to $US45.20 a barrel on the New York Mercantile Exchange. Petrobras said that Tuesday’s production would likely fall by 8.5%. Meanwhile, oil shipments from the Zueitina port in Libya have been halted amid escalating tensions between the two ruling governments. Following the port’s closure, Libyan production is expected to drop below 400,000 barrels a day.

Brent’s spot contract and oil slated for delivery in a year was at a discount, or “contango”, of almost $7 a barrel, the biggest in two months. Managed money holds 273,436 long positions, compared with 134,264 short positions.

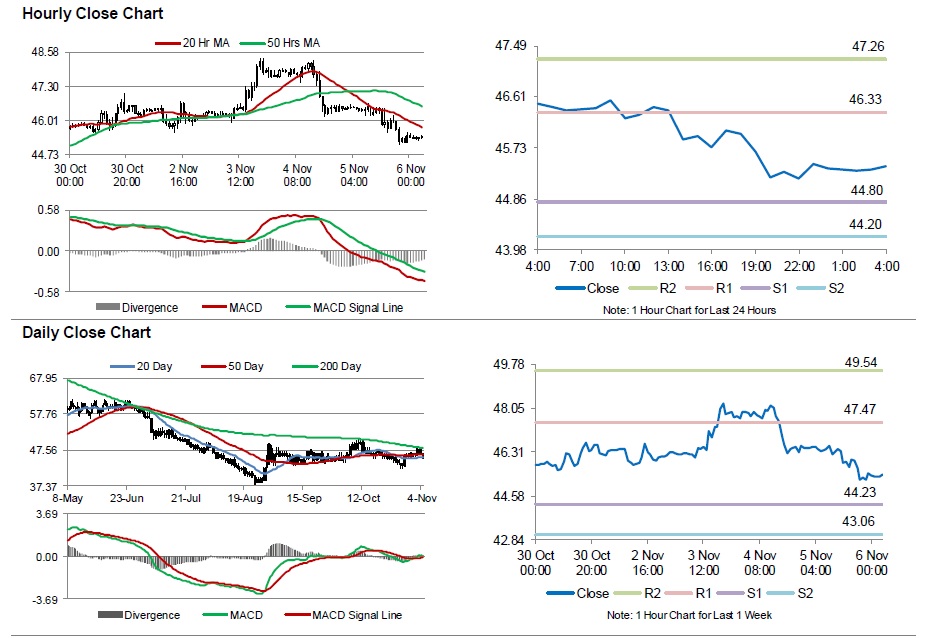

WTI crude futures rose 10 cents to $46.42 a barrel, having lost 3 % the day before. Global oil supply and demand will begin to move into balance by late 2016 or 2017 and prices may rise to US$70 to US$80 a barrel by the end of the decade, he said in Tokyo on October 30.

For the coming week bunker prices are expected to edge downward again after the recent rallies. Production added 1.29% to 9.70-M BPD, while imports gained 1.83% to 0.72-M bpd. Its 2010 report did not mention shale oil as a serious competitor, highlighting the dramatic change the oil market has undergone in the past few years. Santos Ltd (ASX: STO) bucked the trend, trading flat at $5.99. Prices are down 4.9 percent this week.

Oil is trading below $50 a barrel, less than half its level of June 2014.

Crude oil prices dipped on Wednesday following a report from the Department of Energy that showed an overall draw in commercial petroleum stocks.