U.S. economy seen expanding 2.3 pct in 4th qtr -Atlanta Fed

“It is quite clear that the Fed would be warranted in hiking in December in case the market does not strike another air pocket”, Jacobsen said.

Fischer said a Fed rate hike will depend on how the economy is performing when officials meet on December 15-16.

The policy makers spoke Thursday as investors seek hints regarding both the timing of an initial liftoff and the pace of subsequent increases. Raising rates would begin to reduce that. Interest rates determine borrowing costs and can affect your pocketbook whether you are a saver, borrower or investor.

“If the dollar does stabilise or weaken after the first Fed rate hike, then there will be no plunge in equities, and especially not in Asia”.

The question now is when the Fed will raise rates for a second time, and a third.

The Fed says it plans to move slowly because the economy remains weak, a point that Dudley emphasised. In October, producer prices for goods fell 0.4%, led by a big drop for light trucks, energy prices were flat and food prices dropped 0.8%. “Consequently, overall PCE inflation is likely on this account alone to rebound next year to around 1-1/2 percent”.

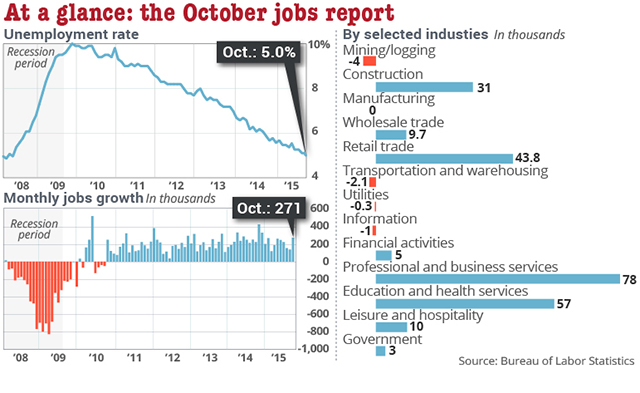

Even though majority of the U.S numbers remained “upbeat” in October, retails sales increased less than expected which suggested a significant slowdown in consumer spending that could possibly temper expectations of a strong pickup in Q4 economic growth. “I would view this as an important policy error”.

NEW United States applications for unemployment benefits last week held steady at levels consistent with a strengthening labour market and job openings rose in September, encouraging signs for the Federal Reserve as it contemplates raising interest rates next month.

“I think rates have already risen, and it’s already priced into the bond market”, Mr. Tipp said. “We have room to accelerate if we find out that we wish we’d started earlier”.

Meanwhile, job openings – a measure of labor demand – increased 149,000 to 5.53 million in September, Reuters added. He added that the worldwide outlook appears less problematic than it did just a few months ago.

The U.S. Dollar Index, which measures the strength of the greenback versus a basket of six other major currencies, closed the week at 98.90, up 0.33% on the session. It has been almost a decade since the Fed last raised rates.

Investing.com offers an extensive set of professional tools for the financial markets. But he had greater concerns on inflation because it continues to fall substantially short of its 2% target and that inflation expectations are under downward pressure.

“As policymakers, we must always be vigilant to events unfolding differently than we expect and we must be ready to act accordingly”, Fischer said in comments delivered to a Fed research conference where Fed Chair Janet Yellen also spoke.