Yahoo board to weigh future of company in series of meetings

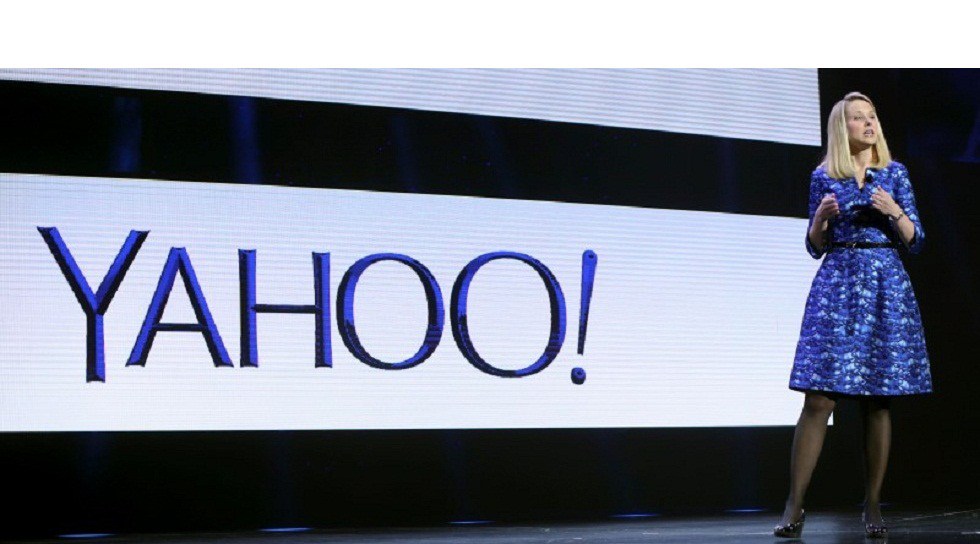

Yahoo’s board is holding a series of meetings this week to discuss whether it should sell its core business instead of its Alibaba stake.

Yahoo’s stock closed at $15.64 when Mayer was appointed president and chief executive on July 16, 2012.

Starboard’s demand evidently prodded the board to consider an alternative way to avoid a tax bill that could wipe out more than two-thirds of the gain on Yahoo’s Alibaba stake, which was acquired a decade ago for $1 billion and is now worth $33 billion. The firm argued Yahoo should proceed with finding a buyer for its Internet business. Earlier this year, there were rumours she might be ousted, and this week, Yahoo is mulling plans to shut down more money-losing divisions.

Although nothing has been confirmed and Yahoo has declined to comment, the sources Reuters is citing are said to be “familiar with the matter”, as they ever are. Under the leadership of Mayer, a highly vaunted Google executive brought in to drive the latest turnaround effort, the company has spent billions of dollars on acquisitions such as Tumblr and Polyvore that have yet to prove their value.

In September, Yahoo’s plans for the spinoff of its stake in Alibaba hit a roadblock when the U.S. Internal Revenue Service denied a request to bless the transaction as a tax-free deal.

“The saving grace for Yahoo is that it still has a relatively large user base that is reliant on the platform so long as they maintain email addresses there”.

“Realizing value is far from assured, however”, Pivotal analyst Brian Wieser wrote in a note. If Yahoo decides to sell its Alibaba shares, this advantage would evaporate. Abaco will hold the Alibaba stake temporarily as Yahoo spins off it to evade tax authorities. Yahoo’s Internet business, which includes services such as Yahoo Mail and its news and sports sites, has been struggling to boost revenue from ad sales in the face of stiff competition from Alphabet Inc’s Google and Facebook. She’s been on the job for more than three years.

“To me that would be most valuable to sell”, said Ivan Feinseth, an analyst at Tigress Financial Partners.

The company’s market capitalisation, however, has grown about 66 percent under Mayer. “Yahoo is the only Silicon Valley company we know that now has a stock price nearly entirely driven by the value of an entity outside of its control”, the letter reads.

Apparently, Yahoo’s stake in the Chinese e-commerce powerhouse, Alibaba Holdings (NYSE:BABA) is not the only thing in question anymore.