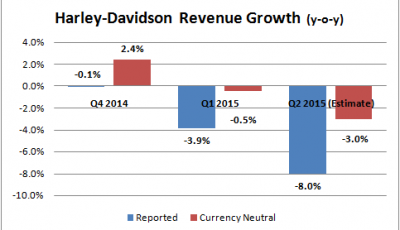

Harley beats expectations despite dollar, pricing headwinds

The Milwaukee, Wisconsin-based motorcycle maker’s second-quarter profit dropped to $299.8 million or $1.44 per share from $354.2 million or $1.62 per share a year ago.

As part of its global growth strategy, Harley-Davidson has largely migrated to a globally consistent model of direct distribution to independently owned dealers and, in recent years, has established direct distribution and operations in a number of its major markets including Brazil, Australia, Italy and the Scandinavian countries.

Harley-Davidson, Inc. has dropped 8.81% during the last 3-month period. Ten analysts have rated the stock with a hold rating and six have issued a buy rating to the stock. 6 market experts have marked it as a strong buy.

According to Fitch Ratings, Harley’s adjusted EBITDA margin in the 52 weeks to March 29, 2015, was 22.1%, and although this figure might slightly decline this year, it is expected to remain at least in the high teens, which is still strong for the sector. Analysts on average had expected earnings of $1.39 a share on revenue of $1.7 billion. RBC Capital lowers the price target from $66 per share to $59 per share on Harley-Davidson, Inc.

HOG is now trading at $57.12, up $2.18 or 3.97%, on the NYSE. That was down from 92,217 bikes in second-quarter 2014. The highest analyst price target sees the stock at $73. (NYSE:HOG) is at $63.1. Harley’s market share is down 4.7 percentage points from a year ago, to 51.3% in the USA, mainly as its Japanese and European competitors took advantage of the strengthening USA dollar, and manufacturing in low-priced countries, and subsequently adopted aggressive product pricing.

Harley-Davidson, Inc.is the parent company for the groups of companies doing business as Harley-Davidson Motor Company (NYSE:HOG) and Harley-Davidson Financial Services (HDFS). The Financial Services segment consists of HDFS, which provides wholesale and retail financing and provides insurance and insurance-related programs primarily to Harley-Davidson dealers and their retail customers.

ManpowerGroup reported earnings of $1.33 per share on $4.86 billion in revenue. The Company conducts its business around the world, including in North America, Europe, the Middle East and Africa (EMEA); Asia-Pacific, and Latin America. HDFS conducts business principally in the United States and Canada.