Saudi posts record $98 billion deficit in 2015: ministry

To counter the shortfalls, Riyadh introduced unprecedented hikes to the prices of fuel, electricity and other utilities by as much as 80 per cent, reducing decades-old subsidies. The 2015 budget was based on a Brent price of $47 a barrel and the same level of crude exports, he said.

The price of 95 RON gasoline was raised by 50% to Riyal 0.9 ($0.24)/liter, while that of 91 RON gasoline was raised by 66.67% to Riyal 0.75/liter.

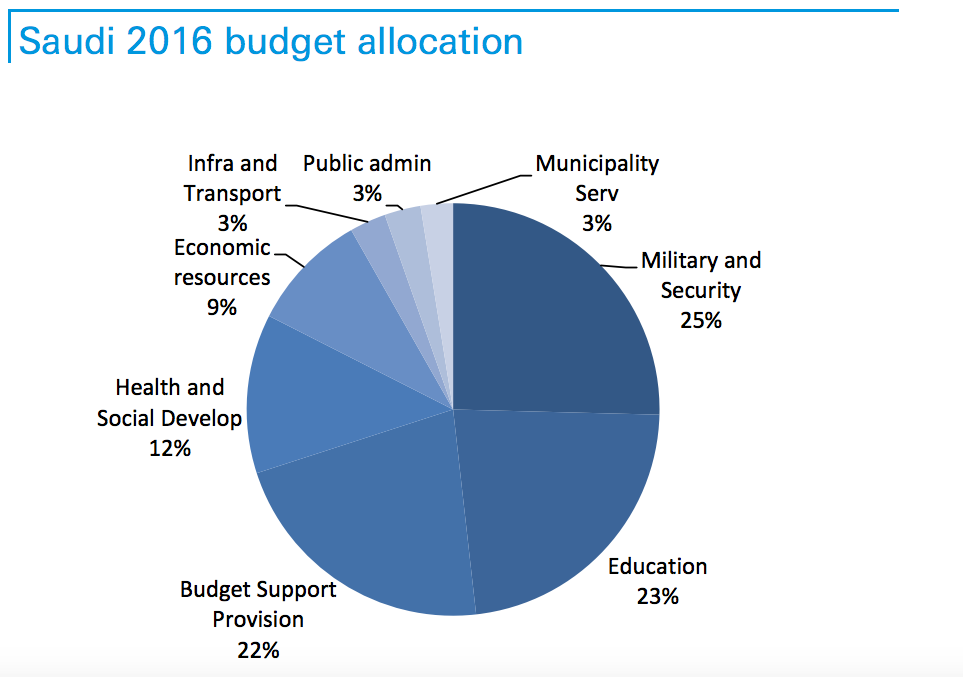

But, as the next chart shows, Saudi Arabia’s military is its biggest single expenditure. “Saudi petchem producers have lost the cost advantage, and they can not pass on this cost in their prices to end-users because that is determined by market forces of demand and supply”, said Iyad Ghulam, analyst at NCB Capital.

“It is natural to expect such measures in these circumstances”, he told AFP while filling his vehicle.

The kingdom has seen a sharp drop in revenues as oil prices have fallen by more than 60 percent since mid-2014 to below $40 a barrel.

Saudi Arabia is the largest member of OPEC and it has consistently refused to cut output in order for prices to go up.

The speculation comes following an announcement of plans to reduce Saudi Arabia’s state budget amid a major budget deficit due to slumping oil prices.

The ministry said oil income made up just 73 percent of total revenues in 2015, way below its contribution in previous years.

Saudi Arabia has so far withstood the cheap oil era by dipping into its massive reserves, but officials are looking for more sustainable sources of revenue, including raising petrol, electricity and water prices. According to Deutsche Bank, the deficit could be closer to 21% of GDP by the end of 2016 if the country overspends as it has done in the past.

The economy is still strong and growing faster than its peers, it said at the time.

“I believe this budget will teach us the art of rationalising consumption”, Twitter user Udai al-Dhaheri wrote.

Domestically, Saudi Arabia’s budget deficit in 2015 was about 367 billion riyals.

Separately, nonoil revenues increased by 29 percent to SR163 billion.

“Budget execution will now be paramount”, said Mr Saliba.

To finance the budget, the Saudi government withdrew from its huge fiscal reserves and issued bonds on the domestic market.