World Bank downgrades global economic forecast for 2016

The World Bank – whose aim is “to end extreme poverty within a generation and boost shared prosperity” – warned that simultaneous weakness in most major emerging markets “is a concern for achieving the goals of poverty reduction and shared prosperity because those countries have been powerful contributors to global growth for the past decade”.

“Spillovers from major emerging markets will constrain growth in developing countries and pose a threat to hard-won gains in raising people out of poverty”, noted the bank report.

The outlook does not include specific figures for Australia which is included in the high income country growth forecast of 2.1 per cent for this year, down 0.2 percentage points from last June’s forecast but up from the 1.6 per cent recorded last year.

He added, “Developing countries should focus on building resilience to a weaker economic environment and shielding the most vulnerable”.

The bank remarks that falling commodity prices and financial instability have “drained global economic activity” a year ago.

Global growth should accelerate to 2.9 percent this year from 2.4 percent in 2015, the bank said, but that still represents a downgrade from its June forecast for 3.3 percent growth.

He also says the risks to the forecast have increased in the last six months, “particularly those associated with the possibility of a disorderly slowdown in a major emerging economy”.

The agency also assumes that the Federal Reserve’s interest-rate hike last month – and any further rate hikes – won’t damage the US economy or cause much turmoil in financial markets.

The WB report, however, cautioned that “a resumption of political tensions” would hinder the steady economy growth.

The World Bank on Wednesday afternoon cut its forecast for global economic growth for the third straight year.

Tola Akinmutimi World Bank Group yesterday raised serious concerns about the weak economic growth among major emerging markets this year.

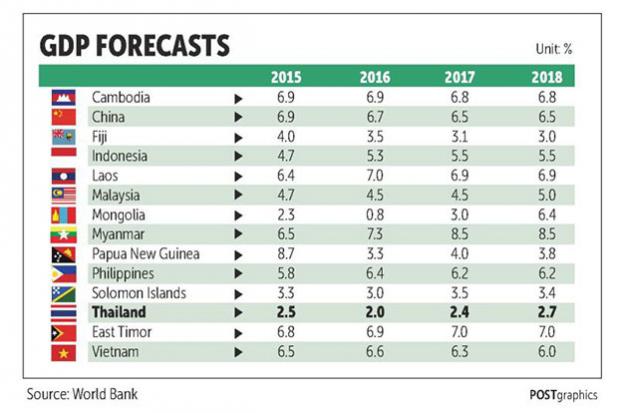

Meanwhile, growth in the East Asia and Pacific region is expected to slow to 6.3% in 2016 from a slightly less-than-expected 6.4% in 2015.

“Growth in Thailand is expected to slow to 2% in 2016 from 2.5% in 2015 as high household debt holds back consumption and export growth is subdued”, the global development lender said in a statement.

The report claims, for instance, that China will continue to slow down, and that recession is set to persist in Brazil and Russian Federation this year.

“If such a Brics growth decline scenario were to be combined with financial sector turbulence, emerging market growth could slow by an additional 0.5 percentage points and global growth by an additional 0.4 percentage points”.

The bank cut its growth rate projection for Japan for this year by 0.4 point to 1.3 percent from the June forecast, citing weakness of consumer spending-led domestic demand and exports.

The rich countries will gain some speed and the emerging economies will grow more rapidly than previous year.

“State-owned enterprise reforms including measures to strengthen transparency and governance would reduce contingent fiscal risks in China, Thailand and Vietnam”, the World Bank said.

The oil-importing countries of South Asia are expected to benefit from lower energy prices.