Oil heads for third weekly drop as global surplus set to worsen

Worldwide sanctions on Iran may be lifted Monday, allowing for a boost in oil shipments from the fifth-biggest member of the Organization of Petroleum Exporting Countries. The collapse in oil prices has spooked financial markets as investors anxious about the health of the global economy, with a slowdown in China and volatility in its markets making for a nervous start to the year.

“With sanctions on Iran likely to be lifted, more oil is flooding the markets”, Commerzbank analysts wrote in a note.

The fall in oil prices, though damaging for oil-dependent developing countries, could provide benefits to motorists in other countries.

Oil prices plunged to fresh 12-year lows on Friday (Jan 15) and dragged down stock markets as dealers prepared for increased Iranian exports to the heavily oversupplied market.

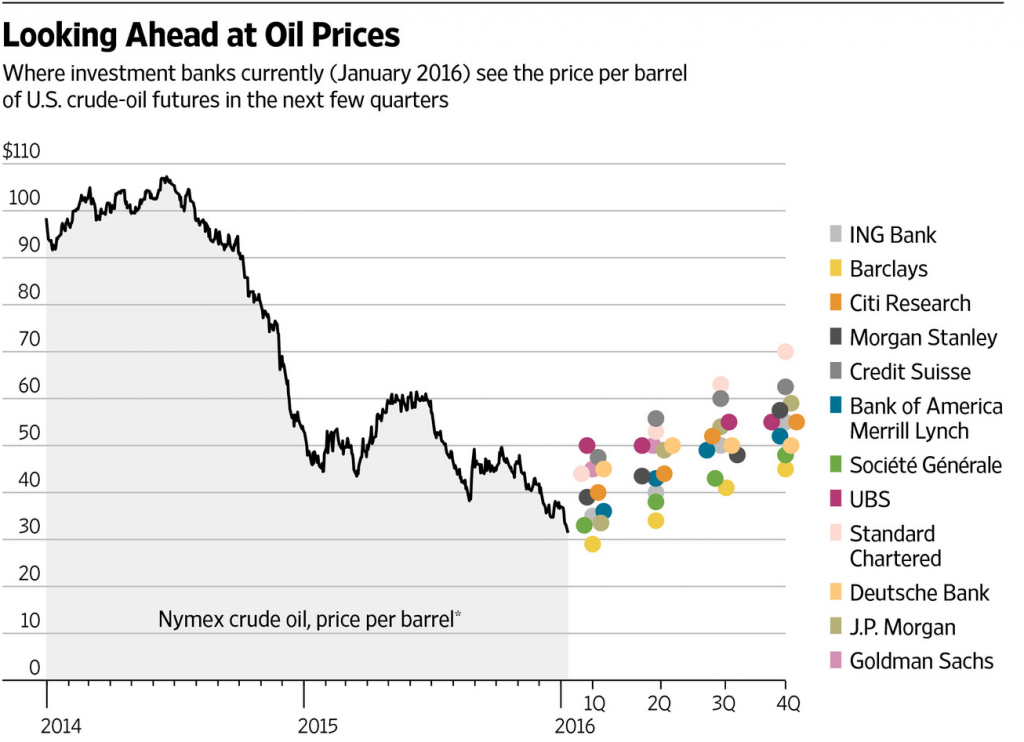

United States benchmark West Texas Intermediate (WTI) for February rose 72 cents to $31.20 a barrel on the New York Mercantile Exchange.

Global crude benchmark Brent broke below $30 a barrel, its lowest since 2004, for a second straight day before rebounding, Reuters reported.

Iran’s sanctions are expected to be lifted in the next few days after it gets a green light from the International Atomic Energy Agency (IAEA), which was tasked with verifying Iran’s compliance with obligations under the nuclear deal.

“It’s all about the Iran situation”, said Bob Yawger, director of the futures division at Mizuho Securities USA in NY.

Iran’s re-entry into the world oil markets in a big way in coming weeks is only the latest development sending oil prices to levels not seen since the early 2000s. Brent crude for February was trading 10 cents higher at $30.41 after lingering below $30 in the morning.

“I think we will see a hard bounce in crude oil – two, three, four dollars back up into the mid 30s”, said Phillip Streible, senior market strategist at RJO Futures in Chicago.

A 8.2 million barrel surge in gasoline inventories and a 6.1 million barrel rise in distillate stocks also pointed to sluggish consumption in the world’s top oil consuming nation. The price decline is affecting producers with BHP Billiton Ltd. expecting to book a $4.9 billion writedown on its USA shale assets, BP Plc planning to cut 4,000 jobs and Petroleo Brasileiro SA slashing its spending plan.

The bank previously predicted $63 per barrel Brent in 2016, but downgraded it to $50, which is still $20 per barrel higher than the current price.

Tehran aims to raise its crude exports by 1 million barrels a day within six months of sanctions being cancelled.