New evidence of rising ‘Obamacare’ premiums

By charting the most commonly-selected plans available to consumers, the analysis reflects new plans in the marketplaces and the effects of insurer competition to attract consumers with lower premiums.

Overall, the number of insurers in the 13 states and District of Columbia that Kaiser examined is dropping to 5.5 for 2017, down from 5.9 this year and 6.4 a year earlier.

Mendelson said that state health insurance departments are most concerned about keeping insurance companies afloat and may have no choice but to approve double-digit increases this year because of the still-shaky marketplace. For example, the study notes that Blue Cross Blue Shield of Rhode Island is proposing to raise in 2017 to $272 from $263 the monthly premium that a 40-year-old would pay for single coverage for a popular silver plan.

Next year’s premiums for health coverage under the Affordable Care Act could rise more than in past years in most markets and declines might be rare, according to a preliminary analysis of insurers’ plans.

The price changes range from a high of an 18 percent premium increase proposed for the second-lowest-cost silver plan in Portland, Oregon, to a low of a 13 percent price cut for such a plan in Providence, Rhode Island. Health care costs generally go up year to year, and this is especially true of pharmaceutical costs over the past few years. The other one-third of individual customers-who make about $47,000 or more per year-must pay the full amount of the premium. “And insurers mostly guessed wrong, and now insurers are playing catch-up”.

Cost concerns have caused several companies to withdraw from the exchanges next year, most notably UnitedHealthcare.

The new ObamaCare grants are meant to boost the built-in protection against premium hikes that most states already have in place, known as “rate review”. In addition, financial problems forced the closure of more than half of the nonprofit insurance co-ops created under the law.

A new analysis from the Kaiser Family Foundation says that, before receiving subsidies, Vermonters age 40 paid $465 per month for the lowest-cost silver health insurance plan through Vermont Health Connect in 2016.

With the new funding, state health departments can hire outside insurance experts to dig deeper into the proposed rates. “Proposed rates aren’t what most consumers actually pay because the vast majority of consumers qualify for tax credits that reduce the cost of coverage below the sticker price, and people can shop around and find coverage that fits their needs and budget”.

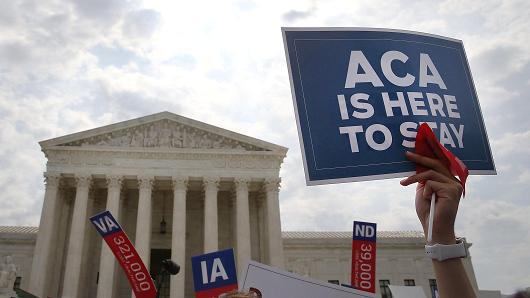

Premiums are also a hot topic politically.

“In a world where we are experiencing adverse selection, rate review is not going to be that effective in bringing costs down”, Mendelson said.

For consumers, the impact will depend on whether they get government subsidies for their premiums, as well as on their own willingness to switch plans to keep the increases more manageable, said the analysis released Wednesday by the nonpartisan Kaiser Family Foundation. “We will be providing our analysis advocating for lower rates to the [D.C.] insurance department”. It is anyone’s guess whether plan premiums might help re-ignite political debate over the ACA and health-care costs; final rates will be public not long before the November elections. Kaiser based its projections on insurers’ preliminary rates filed with state regulators, which remain subject to state or federal review.