Oil prices rise after API reports fall in U.S. crude inventories

Oil prices fell Wednesday after USA energy stockpiles decreased today by a smaller amount than analysts expected.

Crude stockpiles declined by 917,000 barrels, the report showed.

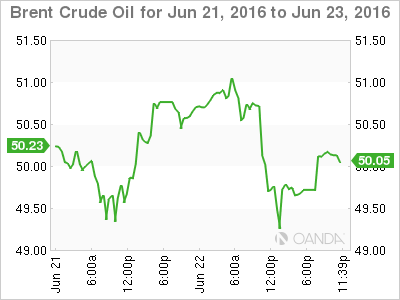

Petromatrix oil analyst Olivier Jakob told the news agency: “What we have is basically the leftovers of the reaction from the API report”. “There is a risk that the DOE will not show a stock draw of the same magnitude”. Chevron gave up 66 cents to $102.58 and Marathon Oil lost 26 cents, or 1.7 percent, to $14.83. Earlier it rose to as high as $50.54, marking the first time it had risen above $50 since June 10.

“Though some may be forgiven for thinking that the outcome is a foregone conclusion, the inconsistency between the betting money and the polls mean that conditions are ripe for a fresh bout of volatility”, said Stephen Brennock of oil broker PVM.

Imports of oil jumped by 817,000 barrels per day from the previous week’s level.

The dollar fell against a basket of currencies.

“Strengthening in the dollar and weakness in other currencies would…be directionally short-term bearish for crude oil” in the event of a British exit, Societe Generale said in a research note. Crude oil market traders remain jumpy over the possibility the United Kingdom will vote to leave the European Union on Thursday in a referendum, with polls showing little difference between the “remain” and “leave” camps. Oil prices were also supported by worries about the possibility of global crude supplies tightening from the economic crisis in Venezuela.