Fed: No rate hike just yet despite job gains

Officials voted unanimously to keep interest rates on hold in the world’s biggest economy for the time being.

Of course, the headline decision doesn’t tell the whole story.

“They definitely won’t say (they will move) because there’s too much data to come, so all they can do is leave open the opportunity”, said Art Cashin, director of floor operations at the New York Stock Exchange for UBS.

Yet Yellen has left little doubt that the Fed is preparing to raise short-term rates by year’s end from the near-zero lows it set at the depths of the 2008 financial crisis.

To see this for ourselves, all we need do is read the language in the actual FOMC announcement, released Wednesday afternoon.

The upcoming reveal of the Federal Open Market Committee meeting minutes is expected to be underwhelming, contrary to the majority opinion, a report from Lindsey Piegza, chief economist with Stifel, said. Growth in household spending has been moderate and the housing sector has shown additional improvement; however, business fixed investment and net exports stayed soft. Well, the Fed statement was carefully crafted/hedged (as usual), with mention of a strengthening labor market and the possibility of a rate increase… perhaps even this year. On balance, a range of labor market indicators suggests that underutilization of labor resources has diminished since early this year.

Avery Shenfeld, senior economist at CIBC Markets, said that he was not surprised with the Fed’s “stand-pat statement”.

However, the committee reiterated that it still expects inflation to eventually return to its 2% target over the medium term as risks to the economy and labor market remain almost balanced.

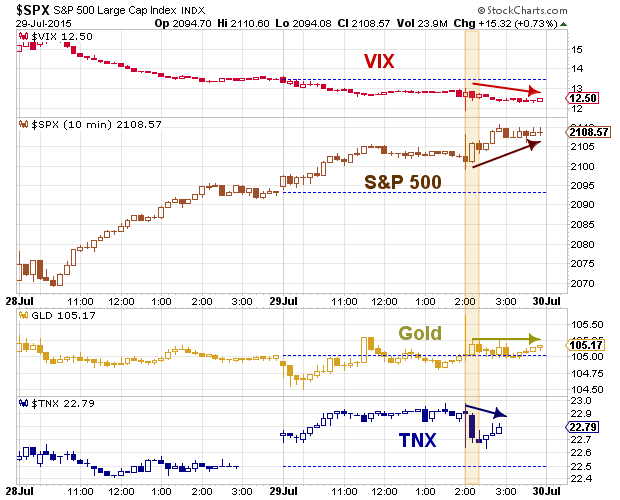

Along with the FOMC statement, US pending home sales, crude oil inventories and any possible adjustment to the Federal Funds rate are slated for release later today. The overall Eurozone rate for June is seen unchanged at 11.0%. “The bottom line is we’re going to have look at the data between now and September”. These two slight changes to the statement have so far lifted the greenback, nudging up expectations for a September hike.

It’s true because between now and September, there’s still a lot of data coming in. Per the fed funds futures contracts, the implied probability of a rate hike in September is around 20%, and the most likely period for the Fed’s first rate hike is in January 2016.

Barring the latter development, I suspect the cost of capital will finally increase in seven weeks’ time. Do you think that will cause stocks to sell off, or do you think a hike is priced into the markets? “I didn’t see anything that changed our minds on that”.

Chandler also noted that the U.S. dollar weakned slightly in initial reaction as there was no explicit mention of a September rate hike; however, he added that the statement also does rule it out either. The indexes closed relatively flat on the day. Traders were looking for a reading of 2.6%.