Canada’s inflation rate 1.5% in June: Statcan

The central bank – which cut rates twice last year to counter the effect of low oil prices – has a 2.0 per cent target for overall inflation, a level last seen in January this year.

The annual core inflation rate, which leaves out some volatile items such as gasoline prices and is watched closely by the Bank of Canada, was 2.1 per cent last month.

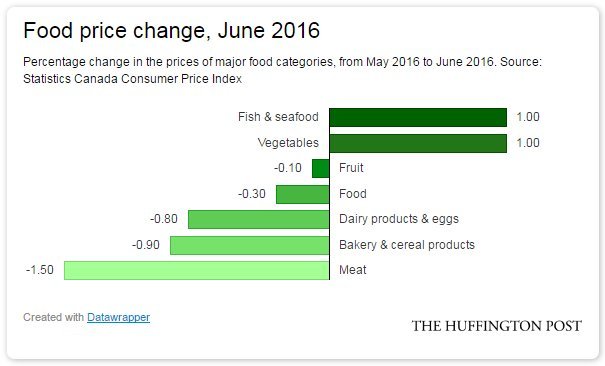

Food and non-alcoholic beverages index group went down to 201.6 in June from 202.2 in May, registering a drop of 0.3 percent.

The consumer price index was 1.5 percent higher in June than a year earlier, Statistics Canada said Friday from Ottawa, slightly higher than the median economist forecasts of 1.4 percent.

It is stated that the housing, water, electricity, gas and other fuels index group recorded an increase of 0.9%, from 179.3 in May to 180.8 in June. For example, prices rose for apples by 19.7 per cent, fresh and frozen fish by 7.4 per cent and lettuce by 5.5 per cent.

The miscellaneous goods and services group contributed 7.7 per cent to the overall increase in the CPI for first half of 2016 compared with the same period of 2015.

In Quebec, consumer prices increased 0.6% in the 12 months to June, the smallest year-over-year gain since February 2014. Core prices were unchanged on the month, versus a forecast of a 0.1 percent decline. Year-on-year, producer prices declined 9.3 percent versus May’s 9.5 percent decrease.

On a seasonally adjusted monthly basis, the CPI increased 0.2% in June, matching the gain in May.

On Thursday, Canada’s May wholesale trade jumped 1.8 percent m/m, higher than the market consensus of 0.2 percent m/m, as compared to 0.1 percent growth in April.