Analog Devices to buy Linear Technology in chips deal

During the late trading hours today, Linear Technology Corporation (NASDAQ:LLTC) stock shot up as high as 31.62%, while Analog Devices shares gained nearly 5%.

The deal, which has a market value of about $12 billion, could be announced as soon as today, Hyman said. Through Monday’s close they were up 15 percent this year. Analog shares, also halted, were up $2.34, or 4%, at $62.87, on the speculation.

The companies announced the acquisition agreement shortly before the close of Tuesday’s regular session, and ahead of Linear’s June-quarter earnings report, after rumors of their talks sent Linear’s shares flying.

The deal is expected to immediately add to Analog Devices’ non-GAAP EPS and free cash flow.

The deal consists of $46 in cash per Linear share, and 0.2321 of a share of ADI, which ADI values at $60 per Linear share.

Founded in 1965 by two MIT graduates, Analog Devices competes with Maxim Integrated Products Inc MXIM.O and Texas Instruments Inc TXN.O .

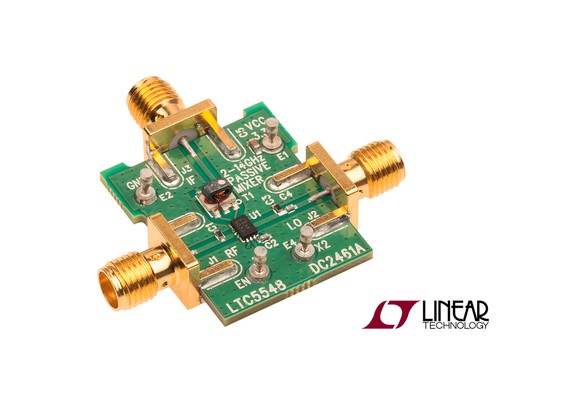

A joint statement said the tie-up would “create a global high-performance analog industry leader across data converters, power management, amplifiers, interface, and RF (radio frequency) and microwave products” with complementary product portfolios. By buying out a rival, National Semiconductor Corp., and updating production, Texas Instruments says it has cheaper manufacturing and more product offerings than any of its rivals. Earlier, Avago Technologies Ltd. took over Broadcom for $37 billion. Its stock hit a record this year.

Before it’s here, it’s on the Bloomberg Terminal.