Chevron Slumps as Q2 Earnings Plunge on Weak Oil Prices

ExxonMobil reported Friday second-quarter earnings plunged by more than 50 percent following the big drop in crude oil prices. ExxonMobil posted earnings of $1 per share on $74.1 million.

Chevron’s net earnings include $1.96 billion in impairments and $670 million in product suspension-related charges. Dow member ExxonMobil’s shares dropped 1.8% to $81.51 in pre-market trade.

Its oil and gas production increased 2 percent to 2.6 million barrels a day in the second quarter, coming from its fields in the United States, Bangladesh and Argentina.

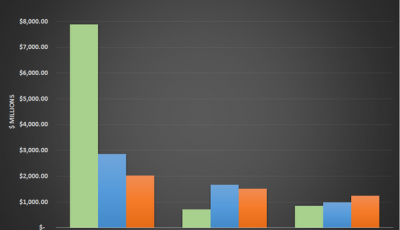

Chemical: This unit contributed approximately $1.2 billion to the company’s profits, up $405 million from the year-earlier quarter. The worldwide upstream operations recorded losses of $1.18 billion. Internationally, the price fell from $101 last year to $56 this year. Chevron’s downstream earnings rose from $721 million to $2.956 billion, including both global and U.S.

It took a $1 billion loss in its U.S. upstream unit because of the write offs, even as its oil and gas output increased in the Permian Basin in West Texas, the Gulf of Mexico and the Marcellus Shale in Pennsylvania. The average sales price for crude/liquids was $50/bbl, versus $92 a year ago.

Chevron shares fell in premarket trading following the announcement. “Our upstream businesses were particularly hard hit, as lower prices reduced revenues and triggered impairments and other charges”. We’re actively managing to a smaller capital program, as projects now under construction come online and as potential new projects are paced and re-bid. “Incremental production and cash generation from these projects and others, along with a curtailed capital program, should provide support for continuing competitive shareholder distributions”.

The sharp earning declines were in spite of a 3.6 per cent increase in production against last year’s second quarter. Its U.S. production was up 9 percent from a year earlier.

Corporate and financing expenses were $593 million for the second quarter of 2015, down $60 million from the previous year’s result, the company said.

Wolfe Research LLC analyst Paul Sankey said the reports by the Big Oil companies to date indicates “this is the beginning, not the end, of the writedown process”.