Crude Oil Falls Sharply From $55 High

Elsewhere, non-OPEC Middle Eastern oil producer, Oman, told customers last week that it would cut its crude oil term allocation volumes by five per cent in March.

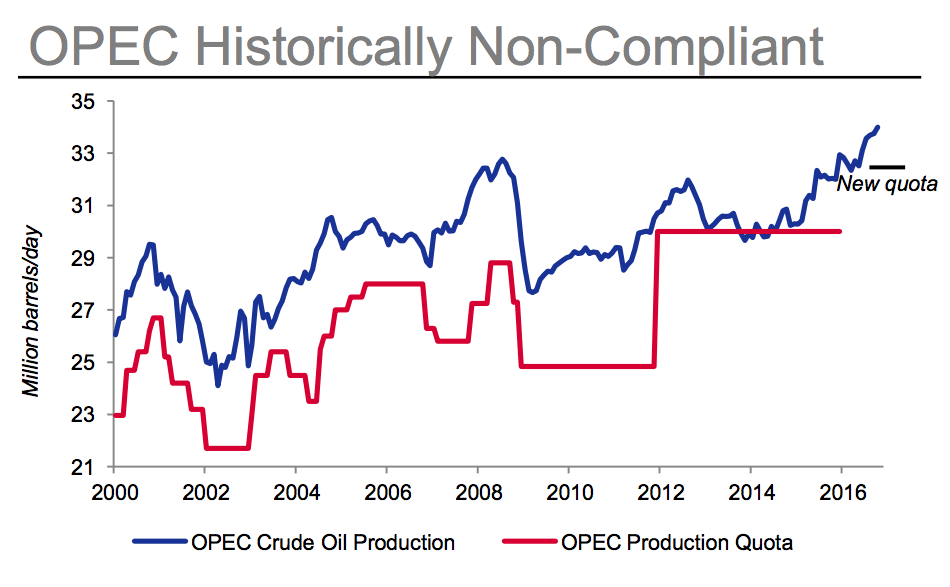

The investment bank’s forecasts hinge on whether OPEC and non-OPEC producers that have joined the cuts would deliver on their promises.

These offerings surged to an all-time record in February when companies raised $6.9 billion in eight deals, around the time crude prices hit $26 a barrel, the lowest point of the year. A government report showed USA fuel stockpiles surged last week as refineries boosted operating rates and crude supplies tumbled.

Oil futures markets were closed on Monday for the New Year public holiday.

But some investors suspect OPEC may not cut production as much as it has promised, keeping stockpiles high. “The Saudis are the most important member and appear to be taking the lead”.

Futures for West Texas Intermediate crude CLG7, +2.29% jumped $1.23, or 2.3%, to $54.95, setting it on track for its highest settlement since July 2015.

The phrase ‘hell for leather’ first appeared in the Rudyard Kipling story, ‘The Valley of the Shadow”, relating to riding on horseback, and defined as “breakneck speed, or with reckless determination’. The futures of Brent oil with March delivery on London’s ICE Futures Exchange fell by 0.19 United States dollars (-0.34%) to 56.27 USD per barrel.

OPEC and key non-OPEC members agreed in November to cut production by 1.2 million barrels per day to reduce the global oversupply.

“We will see whether belief in the (OPEC production) deal will hold”, said Eugen Weinberg, head of commodities research at Commerzbank in Frankfurt.

A Reuters survey of analysts forecast the EIA report would show US crude stocks declined by about 2.2 million barrels in the week to December 30.

Over the course of 2016, the value of Venezuelan oil has increased by 82 percent, rising from a record $24 low in the first trimester of the year to almost $45 in December. A gauge of total US fuel demand tumbled to the lowest level since June 2013.

“Among the challenges are uncertain prospects of the global economy, managing excessive speculation, geopolitical tension, and managing technology advances for efficient exploration and production. Depending on where we close today, we could soon test the $50 area again”.

Oil in morning trade is over US $53 per barrel.