Netflix blows past worldwide subscriber estimates

Those results included 1.93 million new subscribers in the USA, and another 5.12 million in worldwide markets.

In other Netflix news, insider Theodore A. Sarandos sold 91,966 shares of the stock in a transaction that occurred on Tuesday, October 18th.

Prior to the release of Netflix’s fourth-quarter earnings report, shares of the subscription-based online streaming service company rose up to new highs as numerous financial firm and research groups upgraded their rating on the stock ranging from buy or hold as early as a week before the release of the earnings report. Analyst’s mean target price for KSS is $46.57 while analysts mean recommendation is 2.70. These holdings make up 81.74% of the company’s outstanding shares.

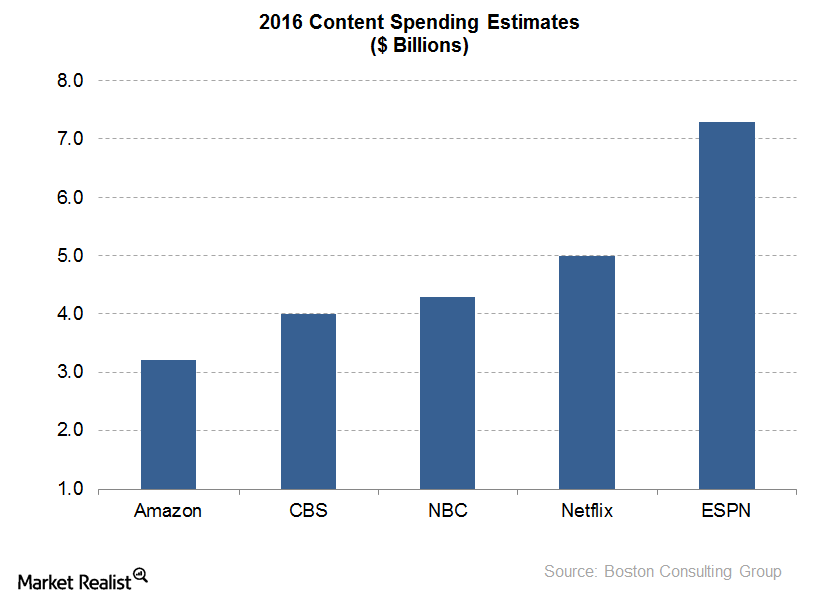

Q4 Revenue: $2.48 billion, to Wall Street estimates of $2.47 billion, up 36% year-over-year. A month ago, analyst EPS consensus estimated earnings of US$0.13 per share. He projects Netflix’s content investment to be at $15 billion per year in the next five years and $25 billion per year in the next ten years. The score shows the rating on a scale of 1 to 5, where 1=strong buy and 5=strong sell. Company has a market cap of $57,377 M. The 52 week high share price is 133.93 United States dollars while the year low stock price is now 79.95 USD. Short interest in the shares accounts for 5.7% of NFLX’s float, which would take traders a week to cover, at NFLX’s average daily volume – plenty of fuel for a short squeeze, should NFLX report another solid quarter. The stock’s current distance from 20-Day Simple Moving Average (SMA20) is 4.03% where SMA50 and SMA200 are 8.2% and 27.18% respectively. Over the 52-week time span, the stock notched a high price of $135.4 and its minimum price was $79.95. And a quick view of analyst notes show that 15 are rating the stock a buy while 9 rate NFLX a strong buy. However its lowest revenue estimates are $2.34B and highest revenue estimates are $2.5B. For trailing twelve months, EPS value for the stock is $4.69.

The firm keeps price-to-earnings ratio at 357.23 in 12 months. SBAC Gross Margin is 73.90% and its return on assets is 1.40%. Therefore, the stated figure displays a quarterly performance of 33.39% and year to date performance of 8.00%.

Beta factor of the stock stands at 0.84. Analysts expected Netflix to report earnings of 13 cents a share on $2.47 billion in revenue, according to Thomson Reuters consensus estimates. Netflix, Inc. (NASDAQ:NFLX)’s highest estimates of price target are $165 and low forecast is $60 based on the opinion of 40 analysts.