IBM Earnings Beat Estimate

Year to Date (YTD) performance of International Business Machines Corporation (NYSE:IBM) is 0.49 percent while its Performance (Week) is -0.56 percent and Performance (month) is at 0.05 percent. Moody National Bank Trust Division scooped up 26 additional shares in International Business Machines Corp. during the most recent quarter end, the firm said in a disclosure report filed with the SEC on Jan 17, 2017.

International Business Machines Corporation (NYSE:IBM) last posted its quarterly earnings data on Monday, October 17th. The reported earnings topped the analyst’s consensus by $0.07 with the surprise factor of 5.70%. Equities researchers at CLSA cut their Q1 2017 earnings estimates for shares of International Business Machines Corp.in a research note issued to investors on Tuesday. IBM has reported the adjusted earnings per share growth of 4 percent to $5.01, beating the analysts’ estimates for the adjusted earnings per share of $4.88.

Overall, IBM claimed: “S$3 trong growth in our strategic imperatives, cloud, analytics, security and mobile”.

In addition to building the infrastructure, IBM will provide the Army with Infrastructure-as-a-Service (IaaS) services, enabling it to provision computing power on an as-needed basis for the most efficient and cost-effective IT.

For the full year, revenues from strategic imperatives increased 13 per cent (up 14 per cent adjusting for currency). Additionally, expanded partnerships to accelerate adoption of enterprise hybrid clouds played a vital role in the growth of these services as well. The increasing strategic imperatives mix bodes well as we look for the company to return to top-line growth.

IBM’s revenue fell 1.3 percent to $21.77 billion in the quarter ended December 31, but beat analysts’ expectations of $21.64 billion. Watson is now embedded in IBM security and will also become part of IBM’s financial services industry solutions. The ingredients are cognitive, cloud, and industry expertise, he said. Such imperatives accounted for more than 40 percent of the company’s total revenue past year and could help the business accelerate its earnings growth in the foreseeable future. To be fair, IBM offers a 3.3% dividend yield – better than the S&P 500’s 2% – which CNBC reports as having paid Buffett $1.7 billion since he started buying IBM stock.

The Global Business Services division (GBS) contributes over 16.7% to IBM’s stock value according to our estimates. “Like many enterprise-focused companies, IBM is having challenges replacing traditional IT revenue with forward-looking revenue”.

International Business Machines Corporation (NYSE:IBM) reported sales (ttm) of 80.21 Billion, whereas, 15 number of analysts estimated the mean sale of 18453.7 million. Wall Street was looking for $79.7 billion in revenue and $13.48 per share in earnings, representing a 2.5% decline and 9.6% decline, respectively.

IBM has been shifting its POWER system platform to address Linux.

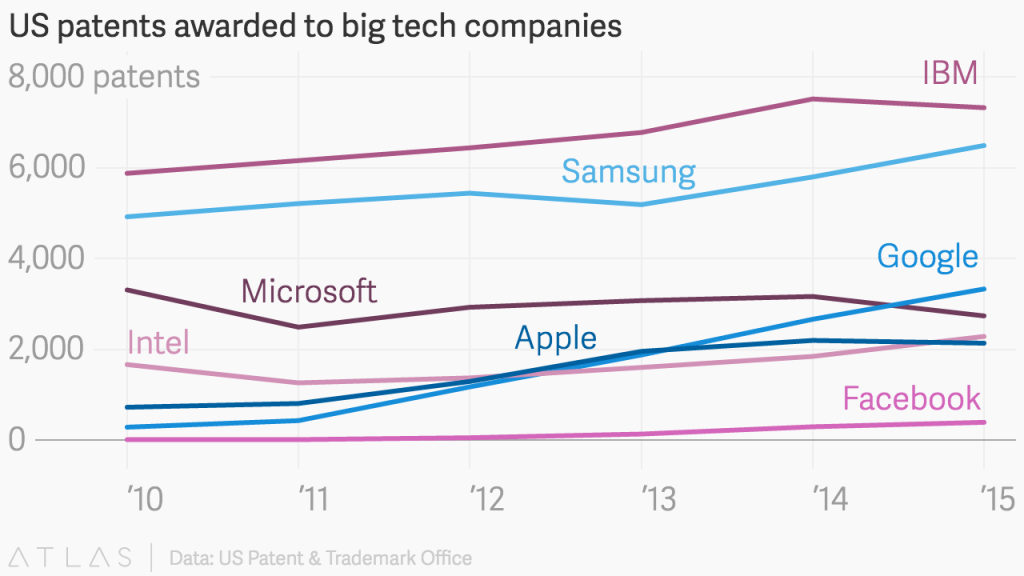

IBM also got a onetime bump in revenues from intellectual property licensing, without which analysts said IBM would have missed forecasts.

IBM’s total put open interest is also docked in the 99th percentile of its annual range, with 216,737 contracts outstanding. Fourth-quarter cloud revenues were up 33%.

During Q4, Storage hardware declined by 10% reflecting the shift in value towards software-defined environments.