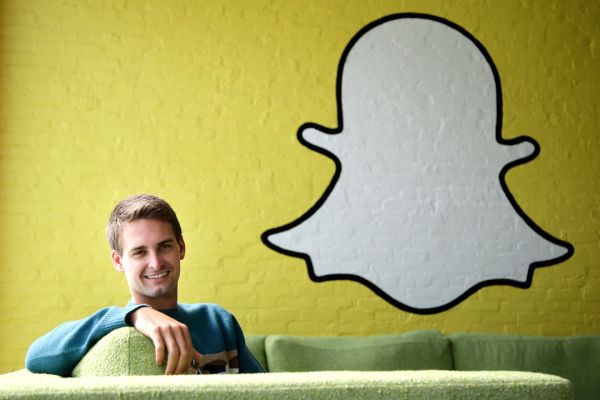

Here’s how much Evan Spiegel is worth after Snap’s IPO

Shares in Snapchat were set to begin trading at around $22-$24 on Thursday (2 March), much higher than in its initial public offering (IPO), as Snap, the owner of the messaging app, made its stock market debut in NY.

Despite a almost seven-fold increase in revenue, the Los Angeles-based company’s net loss widened 38 percent previous year.

Yet among the attractive figures for investors are Snap’s average of 158 million active daily users.

The SF Growth Fund, the school’s endowment fund, was reportedly one of Snap’s first investors in 2012.

Snapchat’s parent company, Snap, to kick off on the stock market at a $24 billion valuation, the biggest tech listing in years.

When it went public in 2013 its stock soared more than 70% on day one. San Francisco-based software startup AppDynamics had been poised to take that title with a $156 million IPO in January, but instead sold to Cisco for $3.7 billion two days before the IPO was set to price.

And, if that’s not enough, he’s entitled to receive another 36.8 million shares over the next three years as a “CEO Award” for taking the company public, according to Snap’s IPO filing.

Mark Zuckerberg’s social network now carries a market cap of more than $400 billion, but it had an inauspicious debut in May 2012, requiring the help of underwriters buying back shares to close a few cents above its IPO price of $38. In the 2017 IPO Watch List, you’ll get an inside look at Snap’s exciting prospects and potential challenges. Companies that went public in 2016 raised about $19 billion, the smallest total since 2003. Mr Evan Spiegel, the 26-year-old chief executive, and Mr Bobby Murphy, chief technology officer, were dressed in smart suits and ties. Snap’s pricing valued the company at $24 billion. In addition to Instagram’s massively popular Stories feature, WhatsApp, another Facebook-owned company, launched its own version of Stories last month.

For every investor snapping up IPO shares, about ten times that number were ready to buy, according to Recode and other media reports.

“IPO investors view those as hits to the corporate governance picture but individually they are not enough to turn them off to the investment”, said Matthew Kennedy, an analyst at Renaissance Capital LLC, a manager of exchange-traded funds focused on IPOs.