A Surprising Clue About Oil Prices Today

Iran agreed to a cap that was 90,000 bpd higher than its level in October 2016 (as reported by the OPEC Secretariat), but recent public statements from Iranian officials have put the country’s current output higher than the cap.

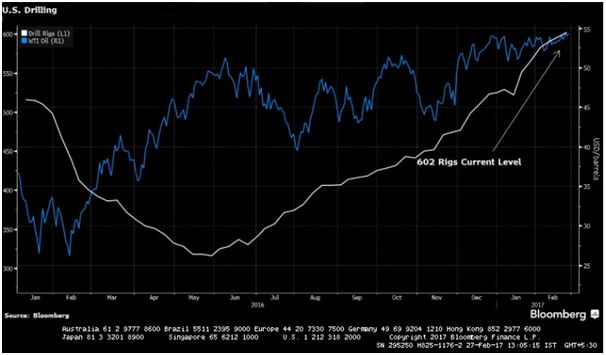

USA crude oil production appears to be rising strongly thanks to increased shale drilling as well as rising offshore output from the Gulf of Mexico. However, if it was a little exceeded, oil production cut in January will cover this surplus, he said. Ever since the Organization of Petroleum Exporting Countries sealed an internal deal as well as one with a major non-OPEC, Russia, to cut production from 1st January to June 2017 to support falling prices, WTI prices have been steadily rising. The promised cooperation from non-OPEC countries is not likely to be delivered as pledged, as much of the claimed cuts of 558,000 bpd come from natural declines in production due to lower prices.

The Azerbaijani Energy Ministry revised its forecast for oil output, following the struck of the first since 2001 deal between OPEC and non-OPEC states to curtail oil output jointly. “The technical possibility of the deal extension is envisaged by the agreements”.

Refinery utilization rose 1.7 percentage points to 86% of operable capacity, still well below 88.3% seen at this time a year ago.

Iran can now refine 1.7 mb/d of crude oil by its refineries.

OPEC has made a decision to produce 1.8 million barrels less per day to end the global oil oversupply.

On the other hand, Goldman Sachs predicted that although crude oil inventories in the USA are expected to rise, the global oil market is showing signs of tightness and will continue to see crude stocks draw down. Distillate production averaged 4.8 million barrels a day last week, up by 300,000 barrels a day compared with the prior week’s production.

Traders are more and more confident that the oil market will experience tighter conditions as we move into the second quarter, a bet that is reflected in both the time spreads and the exceptional buildup in bullish positions on crude oil.

US crude prices have roughly doubled over the a year ago which has supported a sharp expansion in domestic drilling activity. European energy companies like Austria’s OMV and France’s Total also signed memorandums of understanding of their own, Press TV wrote.

On the other hand, the data showed the producer/merchant category increasing its short position by 22,481 contracts to 341,911 contracts.

India’s imports grew to 546,600 bpd, while South Korea’s purchases rocketed to 410,387 bpd. The trader no longer stores oil on tankers because of the disappearing contango. That’s boosting the dollar at oil’s expense. The benchmark Brent crude futures LCOc1 were yet to start trading after falling 2.3 percent on Thursday. “The oil output was reduced by over 30,000 barrels”, Bozumbayev said.

Here is a look at how share prices for two blue-chip stocks and two exchange traded funds reacted to this latest report.