Snap Inc. said to price shares in IPO at $17 each

Snap made a decision to go public at a particularly interesting time for the company. That prospect has sparked a backlash from some major institutional investors, including the California Public Employees Retirement System (CalPERS) and the California State Teachers’ Retirement System (CalSTRS), which sent Snap a letter objecting to the plan.

Snap’s IPO order book was more than 10 times oversubscribed and could have allowed the company to price its shares at as much as $19 a share. Would Snap be offering a fun, affordable alternative to the current drone enthusiast market, now dominated by professional-leaning drones like DJI’s Phantom?

That places a current valuation of Snap at $28bn, with Evan Spiegel and co-founder Bobby Murphy’s holdings worth about $5bn each.

That pricing values the five-year-old company, based in Los Angeles, at $24 billion.

Snap only began making money two years ago and is still struggling to turn a profit.

“Grow”, said Jeff Kagan, an independent industry analyst.

Nicole Bullock, the USA equities correspondent for the Financial Times, people were excited about the float because there had been a drought of big tech companies listing for the last few years. “They must continually be a different company”. “I guess that will start moving to the front of investors’ minds as we move toward the company’s first earnings report”.

“The company needs a well-thought-out acquisition strategy”, she said.

Snap wants to do the same. “The company needs a roadmap so it can figure out which companies it can buy to get them to their goal”.

Nevertheless, it looks like there’s still some air left in the social media bubble.

Proceeds from the U.S. IPO market were only 18.8 billion dollars past year down from 86.6 billion dollars in 2014, according to Renaissance Capital.

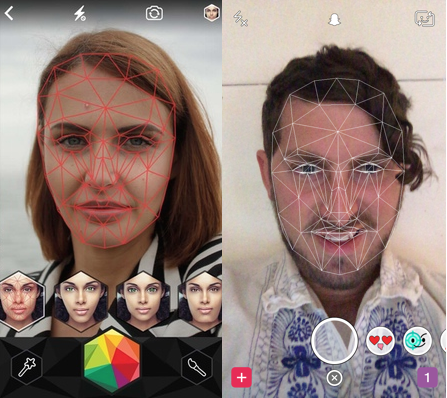

Social media giant Facebook has even tried taking a page from Snapchat’s playbook. With the feature, photos and videos shared by users play in a loop for 24 hours, then disappear. After all, Snap’s shareholders will still retain one lever of control: “Investors can vote with their feet”, Feldman says.

But some analysts still caution that Snap has to prove itself.

It appears a lot of younger investors were particularly interested in Snap, according to data from stock trading app Robinhood.