Bitcon prices surges past the price of gold

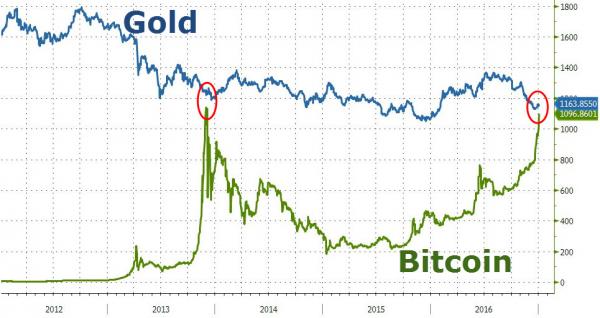

The gold price fell for a third straight session to $1,240.00 per ounce while the Bitcoin price rose to $1,260.00 by late-morning trading on Thursday. On Friday, the gulf widened. The price of yellow metal has declined more than 2 percent this week. Crude oil and bonds are the only other instruments that have come near to the investment risk of Bitcoin.

A brief dip followed before price took off again, touching $1,298 at 13:00 today, a new all-time high for the world’s most prominent cryptocurrency. The moment is becoming even more important taking into account that gold is named the “gold standard” of alternative assets. Gold and bitcoin crossed paths overnight. “80% of bitcoin is exchanged for Chinese yuan”, read a Quartz headline. At the time of writing the price of Bitcoin stands at $1,286.

Gold is usually in demand during uncertain times, but the market appears to have a lot of trust in President Donald Trump’s ability to cut business regulations.

The usage and popularity of this relatively newer form of currency (often called as digital cryptocurrency), has been on a rise lately.

The value of bitcoin has been volatile since it was first launched in 2009, with many questioning where its future lies. A bitcoin is essentially a computer file. Anyone can send and receive bitcoins. There is no database to keep track of the codes, so there is no record of the destination of the transaction.

Bitcoin has set a new all-time high every day in March. Bitcoins are mined using computers. The first big spike in value starting around January 2016, with another big spike hitting last summer and then this past January.

The EU is now preparing legislation to end Bitcoin anonymity with the creation of a database with Bitcoin wallets and real-life identities.