Following Its Blockbuster IPO, Snap Now Faces Some Growing Pains

Early indications pointed to Snap shares opening up at between US$22 and US$24.

Shares started trading at $23.70, up from their IPO price of $17.

Proceeds from the U.S. IPO market were only 18.8 billion dollars previous year down from 86.6 billion dollars in 2014, according to Renaissance Capital. That, in turn, had created the biggest stir since Facebook made its debut on Wall Street in 2012. But the biggest unicorns, Uber and Airbnb, are not expected to seek an IPO this year. While the company was hoping to sell $3 billion worth of stock at $15 a share, giving a valuation of roughly $21 billion, Snap will now have around $4 billion in cash.

Not today, and not this month, but eventually, many investors, even ones who bristle at Snap Inc.’s share structure, will wind up owning a piece of the Venice company.

And, if that’s not enough, he’s entitled to receive another 36.8 million shares over the next three years as a “CEO Award” for taking the company public, according to Snap’s IPO filing. The IPO reportedly is oversubscribed, showing strong investor interest.

Yet, Snap is also one of the few billion-dollar tech startups choosing to go public and by far the largest. According to a report in New York Times that quotes people briefed about the project, Snap’s drone will take overhead pictures as well as shoot videos to make visual data available to the company.

The rebranding itself – from Snapchat to Snap – mirrors the company’s efforts to expand beyond just Snapchat, and a Snap camera drone could bolster its position as a camera company.

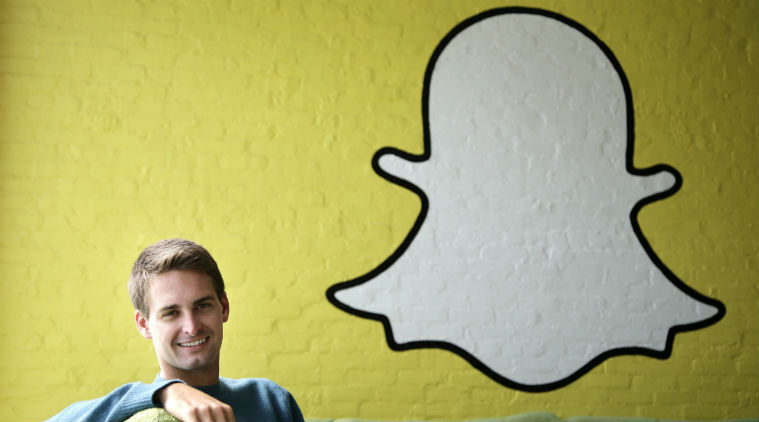

The shares were popular despite the IPO being unusual in that investors got no voting power – with its co-founders Evan Spielgel and Bobby Murphy continuing to maintain tight control over its future.

Snap also wants to avoid the fate of Twitter, which came public in May 2013 amid sky-high expectations.