Chesapeake Energy Corporation (NYSE:CHK) Shares Dip Under Moving Averages

CHK right now sits at consensus rating of 2.90 while 4 analysts have advocated the shares as “BUY”, 2 calls it an “OUTPERFORM” and 23 suggest “HOLD”. In the last six months the stock’s performance plunged -16.22% while yearly performance of the company advanced 24.59%. As part of this plan, the Company’s Appalachian area annual production volumes are expected to grow approximately 17% (using midpoints) over 2016 and approximately 40% based on exit production rates.

Many analysts are providing their Estimated Earnings analysis for Chesapeake Energy Corporation and for the current quarter 22 analysts have projected that the stock could give an Average Earnings estimate of $0.17/share.

02/24/2017 – Chesapeake Energy Corporation was upgraded to ” by analysts at UBS.

Currently, Wall Street is projecting that the firm will post $0.2 earnings per share. Currently, the stock has a 1 Year Price Target of $7.53. The company’s target price is 7.53.

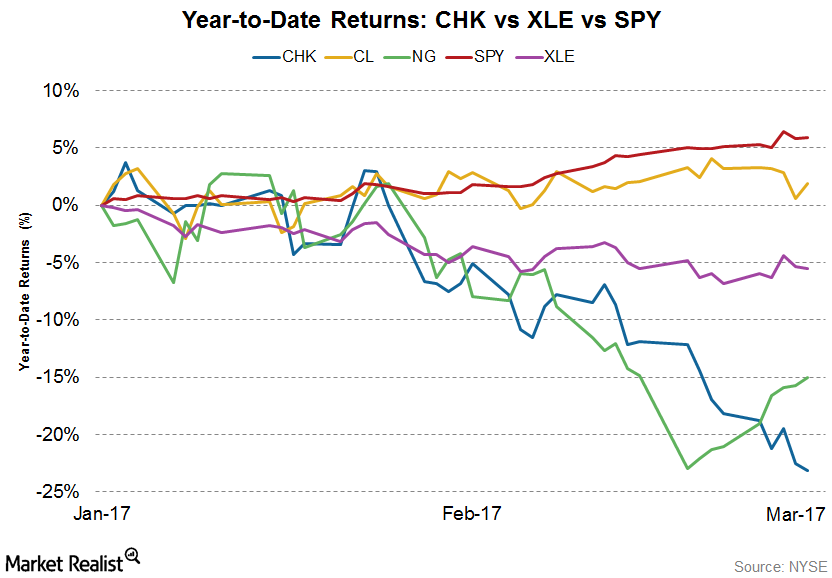

The share price of Chesapeake Energy Corporation (NYSE:CHK) was up +0.56% during the last trading session, with a day high of 5.42. The latest exchange of 17.59 Million shares is above its average trading activity of 1.5 Million shares. The company has a market cap of $4.78B and now has 894.06M shares outstanding. Chesapeake Energy Corporation (NYSE:CHK)’s distance from 20 day simple moving average is -12.11% whereas its distance from 50 day simple moving average is -19.62% along with -10.11% distance from 200 day simple moving average. The stock was last seen -0.75% lower, reaching at $5.32 on March 3, 2017. In essence, the P/E ratio of Chesapeake Energy Corporation specifies the dollar amount an investor can anticipate to invest in the company to receive one dollar of the company’s earnings. (NYSE:FTI) reported an EPS actual of $0.35. Beta value of the stock stands at 2.00.

A current consensus EPS projection for next fiscal year is observed at $1.16 and one month ago consensus EPS forecast was at $-0.10. According to analysts minimum EPS for the current quarter is expected at $0.08 and can go high up to $0.31. Chesapeake Energy Corporation’s market capitalization will expectantly allow investors to gauge the growth versus the risk potentials. If you are reading this report on another domain, it was illegally stolen and reposted in violation of USA and global trademark & copyright laws.

A number of key analysts, polled by FactSet, shared their views about the current stock momentum.

Multiple company employees have indulged in significant insider trading. Van ECK Associates Corp increased its position in shares of SM Energy by 2.2% in the fourth quarter. For the past 5 years, the company’s revenue has grown -8.1%, while the company’s earnings per share has grown -2.5%. BlackRock Group LTD boosted its position in shares of Chesapeake Energy by 14.2% in the third quarter.

Another insider trade includes General Counsel Webb James R who also initiated a transaction in which 24188 shares were traded on 13 Jan 2017 as “Sell”.

On 12/16/2013 Chesapeake Energy announced a quarterly dividend of $0.09 1.33% with an ex dividend date of 1/13/2014 which will be payable on 1/31/2014.

The Company now has Insider ownership of 1 Percent and Institutional Ownership of 70.3 Percent. The Company is engaged in the acquisition, exploration, development and production of crude oil and condensate, natural gas and natural gas liquids (NGLs) in onshore North America. The marketing, gathering and compression segment is responsible for marketing, gathering and compression of oil, natural gas and NGL.