Oil to Hit $40 If OPEC Fails to Expand Cuts, Pioneer Says

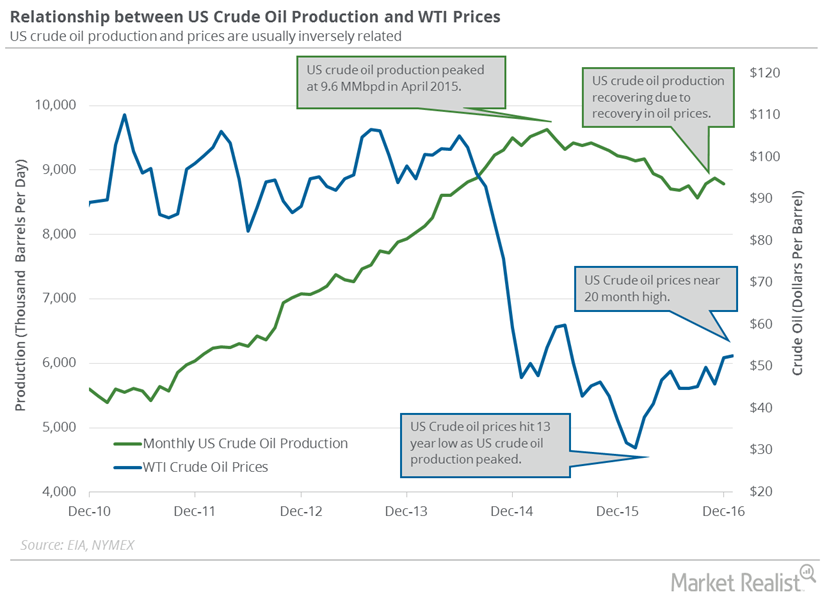

EIA reported that US oil output rose by 56,000 barrels-a-day last week to 9.088 million barrels-per-day – a 13-month high.

The supply data spooked investors who have been betting that production cuts by the Organization of the Petroleum Exporting Countries and other exporters would help work off the glut of oil that has weighed on prices since 2014.

Whether that eventuates will likely be determined when OPEC meets in Vienna on May 25.

Overall, he said the production reductions have had their intended effect, citing greater price arbitrage between east and west oil markets that “indicate the cuts are biting”. Stockpiles have climbed to 520.2 million barrels, the highest level in weekly data compiled by the EIA since 1982.

A worker at a makeshift production camp in Nigeria’s swamps processed crude oil at an illegal oil refinery site near the river Nun in Bayelsa.

But that bullish sentiment has wavered with Russia’s lackluster participation in the cuts, rising US shale output and signs OPEC countries began increasing crude exports in February. Since May they have nearly doubled the number of active oil-drilling rigs in the country, helping lift the nation’sproduction above 9 million barrels a day for the first time in nearly a year. The demand and supply trends point to a tight global oil market, with spare production capacity in 2022 falling to a 14-year low.

Echoing the International Energy Agency’s call yesterday, Falih said longer term he was concerned “that misguided projections of peak demand” may discourage trillions of dollars in investments needed to maintain the global energy infrastructure, which would trigger “heightened market volatility including damaging price spikes”. Compliance among top global oil producers should improve in February from January, he said. Capping any upsurge has been an increase in U.S. shale oil drilling after WTI rose firmly above $50 a barrel in December following OPEC’s sealing of the deal, which also included several non-OPEC producers such as Russian Federation.

“Some have not lived up to expectations”, al-Falih said, “but as a whole if you look at the totality the agreement is working well”. OPEC was used as the vehicle to drive away Shale players out of business, or so Saudi thought.

Still, Barkindo said Tuesday that U.S. producers may have been impacted more than any other group in the global decline in oil prices, which he said caused United States production to decline by about 1 million b/d. Analysts say the decline in oil was also accelerated by the rush of speculators out of long positions.

During the 2-plus year price downturn that was precipitated by the decision by OPEC, namely Saudi Arabia, to “let markets decide price”, the majors and independents alike, have been able to drive operational efficiencies to lower breakeven prices to between $35 per barrel to $50 per barrel.