European Central Bank keeps rates unchanged, raises growth forecasts for 2017 and 2018

The ECB now sees headline inflation of 1.7 percent this year compared with an earlier estimate of 1.3 percent, and 1.6 percent next year compared with a previous 1.5 percent estimate.

The ECB meeting has probably been the most important event this week so far.

The day’s United Kingdom data included solid United Kingdom trade deficit and construction output results from January.

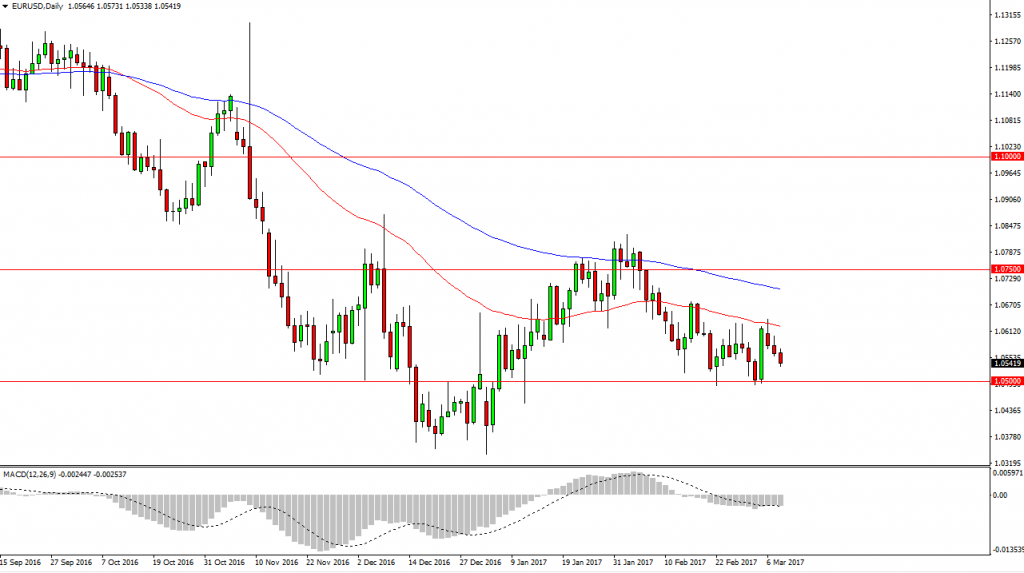

Although the report contradicts what was said in the meeting the Euro rose higher versus the greenback to break resistance that has been in play since late February.

The European Central Bank has chose to keep its stimulus programs unchanged. Surprisingly hawkish statements from ECB President Draghi saw the Euro extend its strength on Thursday afternoon. The broken resistance at 1.0627 is now seen as the first level of support.

Woodside Petroleum fell 1.1 per cent in Sydney and later in European activity, French energy group Total slid 0.8 per cent.

This means investors had largely brushed over the latest United Kingdom growth forecast from the Office for Budget Responsibility (OBR).

Eurozone data has been mixed recently – Manufacturing and Services PMI’s have risen, as has inflation and employment, but other data has fallen, notes Kathy Lien, managing director of BK Asset Management. There are no major economic reports on the calendar for Canada or New Zealand but softer data including the drop in dairy continues to keep the New Zealand dollar under pressure. “Sterling may find itself under renewed rounds of selling if the Brexit uncertainties persist this month”.

This pushed bond yields and the euro higher as markets begin to price in a normalisation of monetary policy, albeit only several months in the future.

Still, there wasn’t a whole lot to build on as we are talking about eventual European Central Bank moves out into 2018, so it’s hard to discern how much euro longs can build on this beyond the next percent or two. The central bank raised its 2017 inflation forecast to 1.7 percent from 1.3 percent, but lifted its growth forecast by a smaller margin, to 1.8 percent. GDP growth for 2017 and 2018 are marginally stronger at 1.8 percent and 1.7 percent respectively. Draghi thus indicated no “sense of urgency” over the requirement of extra stimulus measures for the Euro zone economy. Check. ECB stands ready to act using all the instruments available within its mandate?

As expected, however, the bank’s governing council left its policies of extraordinarily low interest rates and quantitative easing in place despite this and the fact that inflation overshot the target of close to but below 2% for the first time since 2013 last month. Draghi stated several data indicating a dovish outlook for Europe’s economy, stating that the European Central Bank interest rates will remain unchanged.

Still, ECB President Mario Draghi will probably avoid any discussion about winding down asset buys, even pushing back on calls by some rate setters to tweak the ECB’s guidance, giving up its reference to further rate cuts, a possibility markets have already priced out.