Fed interest rate hikes will soon be yesterday’s news

The rate hike will likely do little to impact money made from added interest accumulated via savings accounts.

Over the past 20 years, the federal funds rate peaked at about 6.5 percent in July of 2000, and was above five percent before the market crash in 2008.

The US Federal Reserve raised its benchmark interest rate for the second time in three months amid increased confidence over the prospects of the world’s largest economy.

“With this increase well anticipated by most markets, Keller Williams does not expect any dramatic change in the current path of mortgage rates”.

On the other hand, the price index for personal consumption expenditures reached 1.9 percent in January, which marks its fastest annual pace in more than four years, just shy of the Fed’s 2 percent target. “Yellen has been clear that there are continued structural concerns, most notably the low labor force participation of prime-age workers and also the elevated share of people in part time jobs who want more work hours”, she told NewsHour in an email.

Tax reform and an infrastructure investment package are often mentioned as policy changes on President Donald Trump’s list of priorities that could effect economic growth and, consequently, the Fed’s interest-rate decisions.

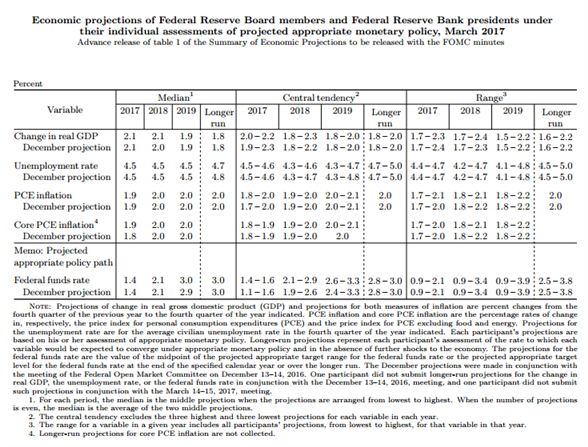

“Unless unanticipated developments adversely affect the economic outlook, the process of scaling back accommodation likely will not be as slow as it was during the past couple of years“, she said. Only three officials saw the need for fewer than three moves this year versus six in December.

This is my bold forecast for the new year. So when the Federal Reserve raises its key rate, banks quickly respond by raising the rate they charge on their credit cards. “The market is ahead of itself already, pricing in a full 25 basis point increase by early next year“.

“It looks like the worst case scenario in terms of uncertainty in the Dutch elections has passed, but the market will be looking at the French election coming up relatively soon as well”, Hynes said.

“When you combine higher mortgage rates with increasing home values, mortgage affordability starts to suffer, and buyers will have to spend more and more on their monthly payments”, Zillow Chief Economist Svenja Gudell noted in a recent press release. “If you’re patient and are reinvesting the income, over time you are going to be better off with the higher income payout”.

“First, the Fed didn’t move up the dot plots, so the decision was more dovish than the market had feared”, Christian Hawkesby, head of fixed income portfolio management at Harbour Asset Management, said.