Traders Secrets on Energy Transfer Partners, LP (ETP), Franklin Resources, Inc. (BEN)

Therefore 65% are positive. The rating was downgraded by Stifel Nicolaus to “Hold” on Thursday, January 28.

Let’s take a quick look at where covering equity analysts see NGL Energy Partners LP (NYSE:NGL) going in the future. The prevailing figure will allow the investment community to determine the size of Spectra Energy Partners, LP in contrast to the sales or total assets figures.

09/06/2016 – Cheniere Energy Partners LP Holdings, LLC had its “overweight” rating reiterated by analysts at Barclays. Mizuho initiated the stock with “Buy” rating in Friday, September 30 report. It is important to mention that target price projections can be very different between analysts.

The stock showed weekly upbeat performance of 0.29%, which maintained for the month at 0.67%. Similar statistics are true for the second largest owner, Energy Income Partners, Llc, which owns 6,317,588 shares of the stock are valued at $271.97 million. It has outperformed by 9.26% the S&P500. When markets become very volatile, this may point to a change in investor sentiment. Its down 0.89, from 1.91 in 2016Q3. Westwood Holdings Group Inc. increased its position in shares of Energy Transfer Partners by 4.6% in the fourth quarter. 58 funds opened positions while 108 raised stakes.

At the end of December reporting period, 124 institutional holders increased their position in Spectra Energy Partners, LP (NYSE:SEP) by some 8,278,632 shares, 104 decreased positions by 4,641,740 and 53 held positions by 49,416,937.

The highest target is $50 while the lowest target is $37.

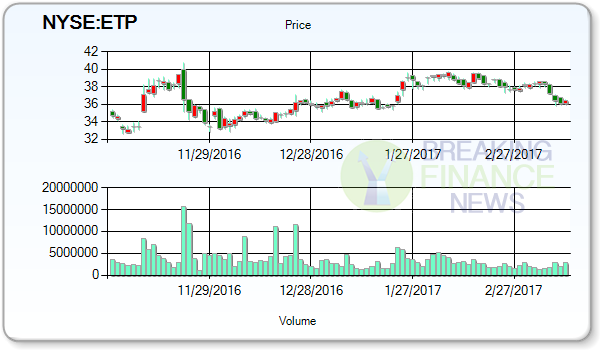

Enbridge Energy Partners, L.P. (NYSE:EEP) topped its 52-week high price target of 26.37 on Oct 10, 2016. Kayne Anderson Cap Advsrs L P invested 1.48% in Tallgrass Energy Partners LP (NYSE:TEP). Northwestern Mutual Wealth Management stated it has 0.01% of its portfolio in Energy Transfer Partners LP (NYSE:ETP). It also reduced Mondelez International Incorpo (NASDAQ:MDLZ) stake by 601,812 shares and now owns 76,158 shares. During period one month ago, consensus EPS forecast was decided at $0.96. 299.53 million shares or 1.33% less from 303.56 million shares in 2016Q3 were reported.

Financial report assessment is one of key elements during price revision, so least variance from what was predicted can culminate in uninvited outcome.

09/11/2015 – Tallgrass Energy Partners, LP had its ” rating reiterated by analysts at Goldman Sachs.

The share price of the company (NYSE:TEP) was up +2.00%, with a high of 53.41 during the day and the volume of Tallgrass Energy Partners, LP shares traded was 183452. It has a target price of 50.71 (IPO Date). It has underperformed by 0.25% the S&P500. The firm has a market capitalization of $3.83 billion, a PE ratio of 23.83 and a beta of 1.00. This is based on a 0 to 100 scale where a lower score indicated an undervalued company and a higher score would represent an expensive or overvalued company. The Company’s segments include intrastate transportation and storage; interstate transportation and storage; midstream; liquids transportation and services; investment in Sunoco Logistics, and all other. At present, 0 analysts call it Sell, while 7 think it is Hold. The share price has declined -6.03% from its top level in 52 weeks and dropped 21.23% this year.

06/02/2015 – Wells Fargo began new coverage on Tallgrass Energy Partners, LP giving the company a ” rating.

02/04/2016 – ENERGY TRANSFER PARTNERS had its “overweight” rating reiterated by analysts at JP Morgan. The firm has “Buy” rating given on Tuesday, October 13 by Canaccord Genuity.