US Republicans working on Medicaid, tax credit changes: Ryan

Federal officials previous year estimated 6.4 million people signed up through the ACA’s insurance marketplaces, while the Kaiser Family Foundation estimated in January that its Medicaid expansion extended coverage to 10.7 million people. “We know that vulnerable people are getting help through the Medicaid expansion”.

The Trump administration is already moving in this direction through the Medicaid waiver system.

Republicans argue that work requirements better prepare participants to transition off government assistance and into jobs.

The reduction in Medicaid spending is only one part of the GOP’s proposal, but it is the part that most worries DE leaders.

“We think we should be offering even more assistance than the bill now does”, for lower-income people age 50 to 64, Ryan said of the tax credits for health insurance that are proposed in the legislation.

In what is now considered to be an opioid epidemic by leading government agencies, these potential changes to the Medicaid expansion could enable and extend the crisis by slashing Medicaid funds by $880 billion over the coming decade. It would essentially set in stone the reimbursement rate the feds now give to Illinois’ Medicaid system. That ended up being the key reason Fitzpatrick couldn’t support the proposed reform.

Without that federal funding, state lawmakers would face a monumental decision: whether to find the money elsewhere, or reduce benefits and enrollments. In some states there is only one health insurance provider and option. And other moderate members of the conference said they would vote no on the current bill the Congressional Budget Office released its analysis Monday.

Driven by the ways in which the bill would seriously harm Americans 50 and older, AARP has chose to make the decision on final passage in the House “an accountability vote”.

The House bill eliminates elements of Obama’s Affordable Care Act, including the individual mandate that penalizes people who don’t have insurance. As originally presented, the GOP’s American Health Care Act would have hit older and low-income people especially hard.

One of the most cynical GOP assumptions is that if such a person drops coverage, they have chosen to voluntarily give up health insurance.

Thus they are paying taxes to support the ACA.

The original bill also would allow insurers to charge these folks more than younger consumers, causing premiums for older enrollees to spike.

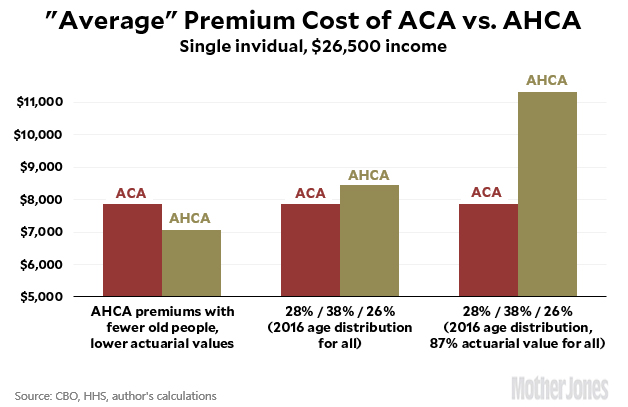

This results, the CBO estimates, in 25 percent lower premium for a 21 year old, 8 to 10 percent lower for a 40 year old, and 25 percent higher for a 64 year old.

The CBO report is reflecting what many who study health policy would have expected because of the types of changes that have been discussed both during the campaign and in some of the previous Republican proposals that have come through in the last few years.

The legislation has drawn the ire of influential groups, such as the AARP.