Oil steadies after last week’s heavy blow

Brent crude futures were up 20 cents at.54 per barrel at 0852 GMT, above a session low of.18, while US West Texas Intermediate futures were up 21 cents at.64 per barrel.

Crude futures kicked off the week higher following sharp declines last week, buoyed by expectations that major producers will cut more of their supplies in a bid to whittle down the still-high global inventories.

The EIA said it expects domestic crude production to rise by more than expected in 2017 to 9.31 million bbl/d from 8.87 million bbl/d in 2016, a 440,000 bbl/d increase.

U.S producers are upping output with rig counts soaring (currently at 877, up 462 from last year) and oil and gas companies are jumping in feet first.

After falling to their lowest levels since OPEC agreed to cut production back in November a year ago, Goldman Sachs have warned oil prices are nearing “capitulation”.

OPEC, Russia and other oil producing nations had agreed to curtail oil production by 1.8 million barrels per day (b/d) for six months, from January 1.

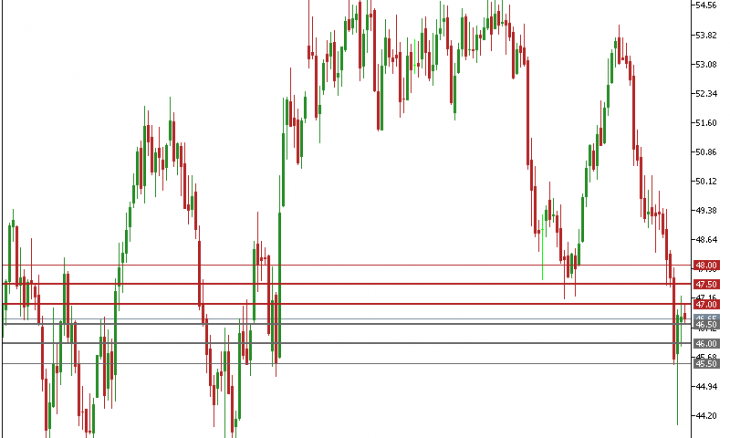

Despite this, both Brent and WTI crude benchmarks are sitting below $50 per barrel as global markets remain bloated due to brimming storage and ongoing high drilling and production.

Despite this, Al-Falih said that markets had improved from last year’s lows, when crude prices fell below $30 per barrel.

If the projection is realised, it would be the highest United States output level in history beating levels last seen during the Texan oil boom of the 1970s, and the more recent uptick in the wake of the shale revolution recorded in 2014.

Nigeria, Africa’s largest economy, seeks for a further six-month extension of its exemption from reducing oil production granted by the oil producers’ group.

Since a low point in May 2016, USA producers have added 387 oil rigs, or about 123 percent, Goldman Sachs said. A third source said an extension of up to one year could be an option.Saudi Energy Minister Khalid al-Falih said on Monday the OPEC-led production cut could be extended beyond 2017.

‘We need to see the OPEC/non-OPEC deal extended to 2018, otherwise there’s a risk oil prices will fall below US40, ‘ Alexandre Andlauer, an analyst at AlphaValue SAS in Paris, said by email.

USA crude stockpiles have declined for four weeks after reaching the highest level in more than three decades at the end of March.

Miners also benefited from the advance in oil prices with Glencore climbing 2.9% and Antofagasta rising 2.5% in London.