Mobile blew Wall Street out of the water with its earnings

T-Mobile US, Inc. (TMUS) now trades with a market capitalization of $50.61 Billion. (TMUS) were valued at $61.24 and moved 0.54% as of a recent closing trade. (NASDAQ:TMUS) in a research note published on Friday morning.

Shares of T-Mobile jumped roughly 3% in after-hours trading following the company’s earnings release. More extreme high and low levels-80 and 20, or 90 and 10-occur less frequently but indicate stronger momentum. Ameritas Investment Partners Inc. raised its stake in T-Mobile US by 0.6% in the first quarter.

“Despite a generally poor operating environment in wireless, T-Mobile continues to fire on all cylinders”. Herndon Cap Management Ltd Liability Company owns 120,037 shares for 1% of their portfolio.

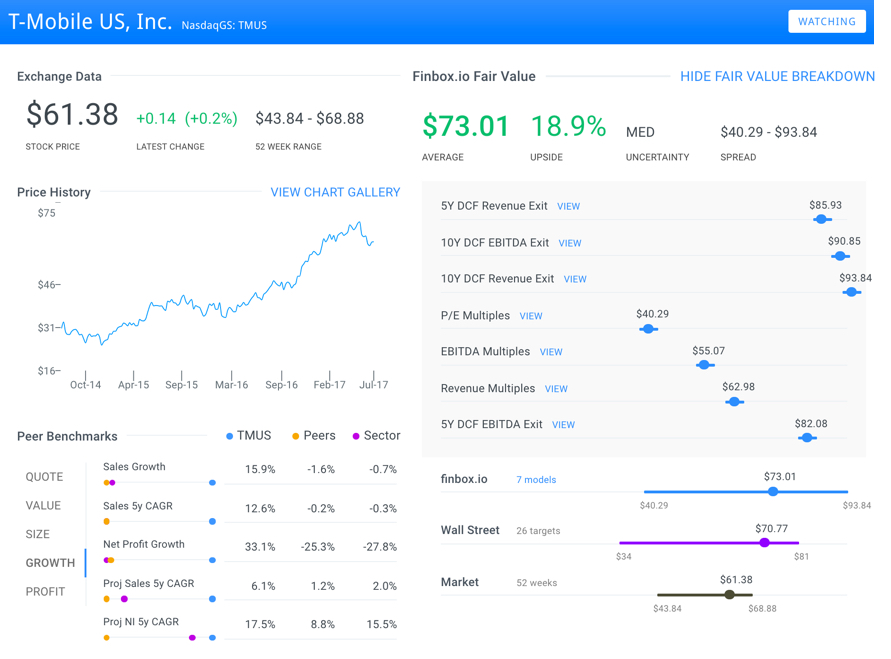

Finbox.io’s intrinsic value estimate of $73.01 implies that the stock is almost 20% undervalued. Wall Street was projecting net additions to decline to 607k, per FactSet.

T-Mobile’s pricing tactics are facing pressure within the prepaid space. Natixis stated it has 0.02% in T-Mobile US Inc (NASDAQ:TMUS). Wholesale customers tallied 13.111 million, declining 11.7%.

“I would say we have the same but maybe more opportunities from an inorganic or an expansion standpoint than we had last quarter”, Legere said yesterday, Athavaley and Venugopal report.

T-Mobile’s sales growth has outperformed and is expected to continue outperforming its peer group. Even as it continues to outpace the rest of the industry in nearly every metric, from net user additions to year-over-year revenue growth, it can’t help but take shots at its biggest competitors, Verizon and AT&T.

Total revenues topped $10.2 billion, up 10% from the prior-year quarter, leading the company to expect to lead the industry in growth for 16th time in last 17 quarters. One could argue that T-Mobile’s growth profile is much more similar to high flying Netflix whose revenue growth has outperformed T-Mobile’s by only 2.0x to 3.0x.

Quarterly branded postpaid phone average revenue per user (ARPU) was $47.01 compared with $47.11 in the prior-year quarter. T-Mobile US also was the recipient of some unusual options trading on Wednesday. Verizon and T-Mobile had forward EV-to-EBITDA multiples of ~6.48x and ~6.52x, respectively, as of the same date.

“We’re actually starting to have conversations about instituting a small quarterly dividend that we can grow in the future”, Chief Financial Officer Braxton Carter said on the call. The company has its outstanding shares of 174.66 million.

The results show T-Mobile emerging as a victor in an industry price war that has every major competitor offering phone discounts and unlimited data plans. The migration to mobile will act as an underpinning to the sector for years to come. “It was the first full quarter with all the unlimited plans on the market”.

TMUS’s fiscal year ends Dec 31, 2016 and the most recent quarter started on Mar 31, 2017. It is meant to chart the current and historical strength or weakness of a stock or market based on the closing prices of a recent trading period. The legal version of this article can be read at https://www.baseball-news-blog.com/2017/07/20/t-mobile-us-inc-tmus-issues-earnings-results-beats-estimates-by-0-29-eps.html. If the share price is now hovering near the 52 week low and the value is achieved in the current past then it can suggest that the price of the shares is likely to go up. I have no business relationship with any company whose stock is mentioned in this article.